What is withholding tax?

Withholding tax (WTH) is tax deducted at source or also referred as retention tax.

A (PAYER) ——–>—-B (RECEIVER)

As per income tax law,

Payer A has to deduct (withhold) a portion of tax before making payment to receiver B.

Payer is supposed to issue WTH tax certificate to receiver B after deducting WTH tax.

Payer is supposed to pay the withhold tax amount to tax authority.

Payer is supposed to file WTH tax returns to tax authority.

Base amount for calculating withholding tax amount? Example

WTH tax amount is calculated by applying a particular percentage rate on base amount.

Base amount for applying WTH tax percentage is always GROSS AMOUNT.

Example:

Company purchases raw material from vendor of 1000 with 20% input tax.

Gross amount = 1000 (net amount)+ 200 (tax)== 1200

Net amount = 1000 and tax amount = 200

As we know WTH tax percentage is applied on gross amount. If withholding tax 10% is to be applied on above transaction then

WTH tax = 10% on gross amount = 10% on 1200 = 120

Vendor will be paid = 1200- 120 (withholding tax) = 1080

Withholding tax percentage is declared by income tax authority.

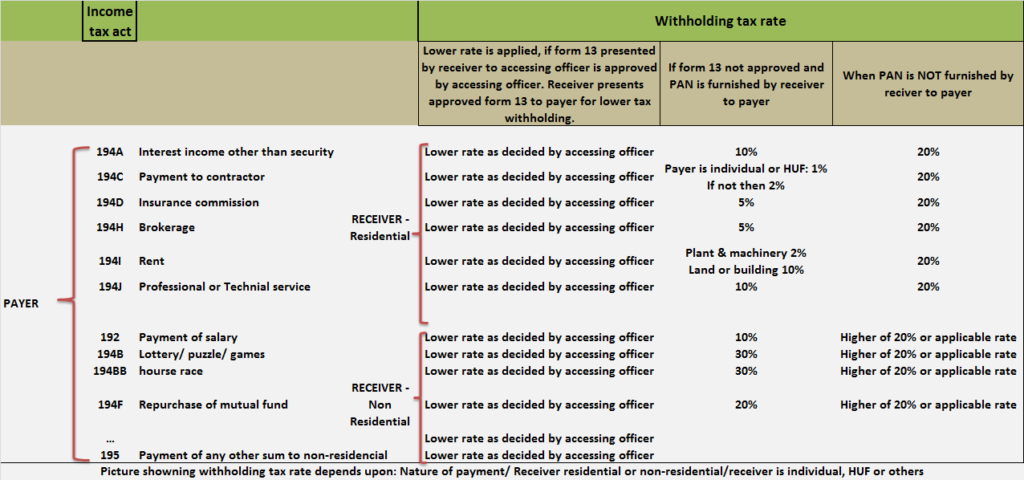

Income tax department has declared different tax percentage for different scenarios (nature of payment/ receiver is residential or non-residential/ receiver is individual or HUF or company).

Let’s try to understand how applicable WTH tax rate is decided for a transaction:

Above mentioned is just few example of income tax act, there are many more sections in income tax act.

As shown above, applicable tax percentage is decided on the basis of:

Nature of payment:

Interest income other than security/ Payment to contractor/ Insurance commission/ Brokerage/ Rent/ Professional & technical services etc.

Recipient (receiver or payee) is residential or non-residential

Different WTH tax rate is applied on transaction depending upon if the recipient is residential or non-residential.

Recipient (receiver or payee) is individual or HUF (Hindu Undivided Family) or other.

Different WTH tax rate is applied on transaction depending upon recipient is company or others.

Lower tax rate as decided by accessing officer

Receiver fills form 13 and submits to accessing officer along with relevant documents. If assessing officer is satisfied, form 13 for lower withholding tax rate is approved.

Receiver presents approved form 13 to payer so that payer deducts WTH tax amount at lower rate.

If receiver does not presents PAN to payer

A residential receiver is supposed to provide PAN to payer, If PAN is not provided then tax applicable will be 20%.

Overall, WTH tax rate depends upon nature of transaction, recipient is residential or non-residential, recipient is company or other than company.

Withholding tax remittance process

Payer who deducted WTH tax amount is supposed to pay the amount to its local tax authority. Each state has its own local tax authority.

Tax payment has to be done on or before 7th of the next month.

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING