Below article will help you understand what configuration is needed in sap to fulfill actual withholding tax requirement as directed by tax authority.

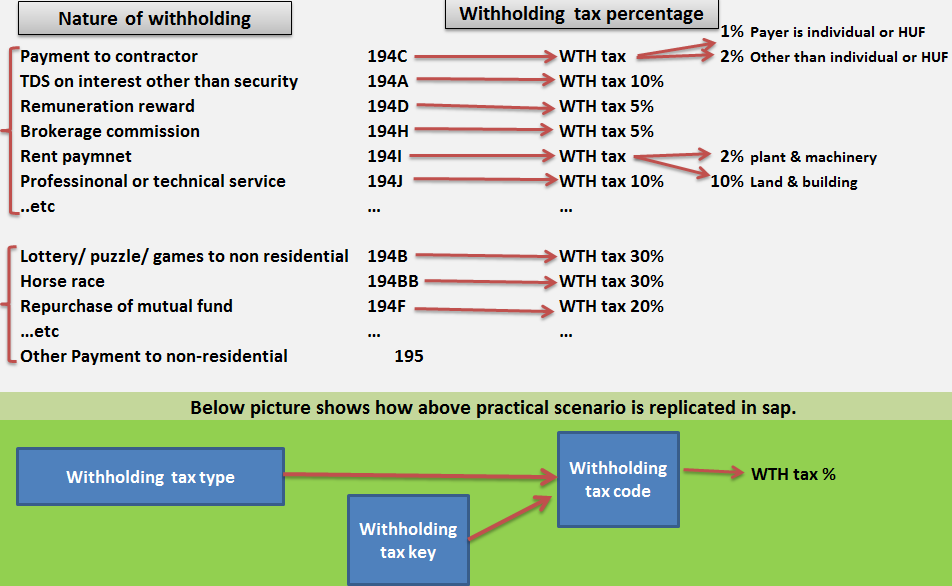

Applicable withholding tax percentage depends upon the nature of withholding. In sap, each nature of withholding is represented as “withholding tax type”.

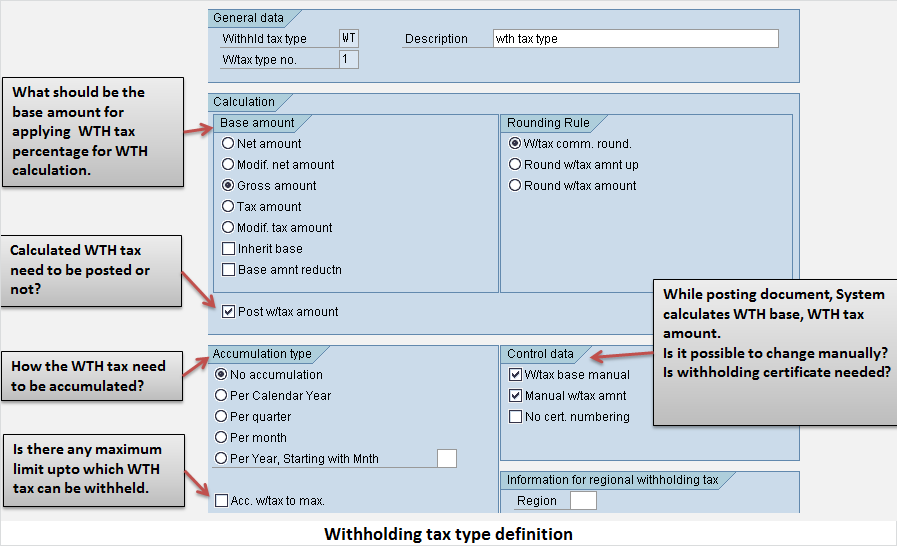

While defining withholding tax type, there are various controls which help us meet the actual withholding requirements as directed by tax authority.

Let’s take example to understand the control fields in withholding tax type

Example: Withholding on rent payment 194I

As per guidelines issued by tax authority, when payer makes payment of rent to residential then payer needs to withhold certain percentage of tax as per below:

Applicable withholding percentage needs to be applied on gross amount.

Apply WTH tax only when rent in the entire year crosses 1,80,000

No withholding to be applied till rent paid in the year is below 1,80,000

Below is how the above requirement can be met in sap:

Hence WTH tax base amount needs to be accumulated yearly with a limit of 1,80,000. Once accumulated base amount crosses 1,80,000 system should start calculating WTH tax.

Whenever payer is making payment to payee, payer is deducting WTH tax amount. Let’s suppose tax authority says that “in the entire year maximum of 3,00,000 from rent payment can be withheld.” Once accumulated WTH tax amount exceeds 3,00,000 no further withholding tax should be applied.

This requirement can be fulfilled in sap by using the field “accumulate WTH tax to maximum” and setting maximum limit of WTH tax to 3,00,000

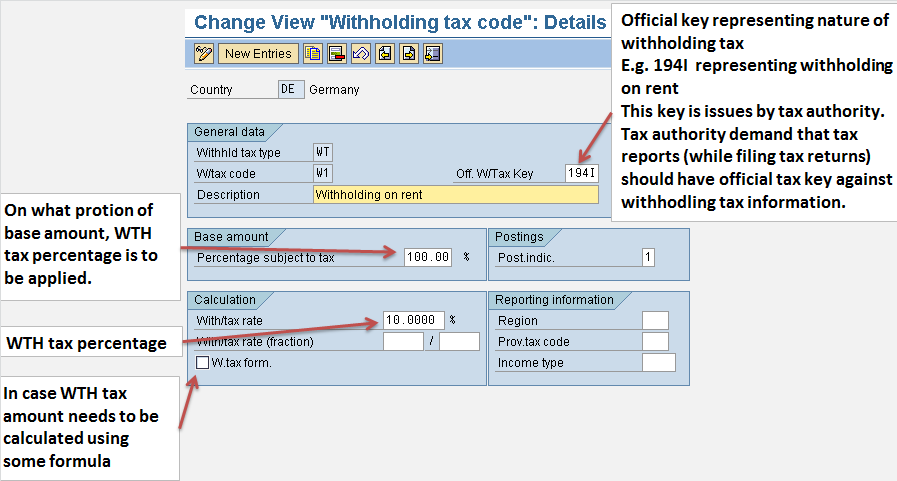

Withholding tax code

The WTH tax percentage that has to be applied is stored in WTH tax code.

WTH tax code defines what WTH tax percentage is to be applied on what portion of WTH tax base.

Official withholding tax key is also maintained in WTH tax code.

In India, each nature of withholding is assigned an official WTH tax key. For example, withholding from payment to contractor (residential) is assigned key 194C while withholding from rent payment to residential is assigned key 194I.

This key is issues by tax authority. Tax authority demand that tax reports (while filing tax returns) should have official withholding tax key against withholding tax information.

WTH key is just for the purpose of reporting.

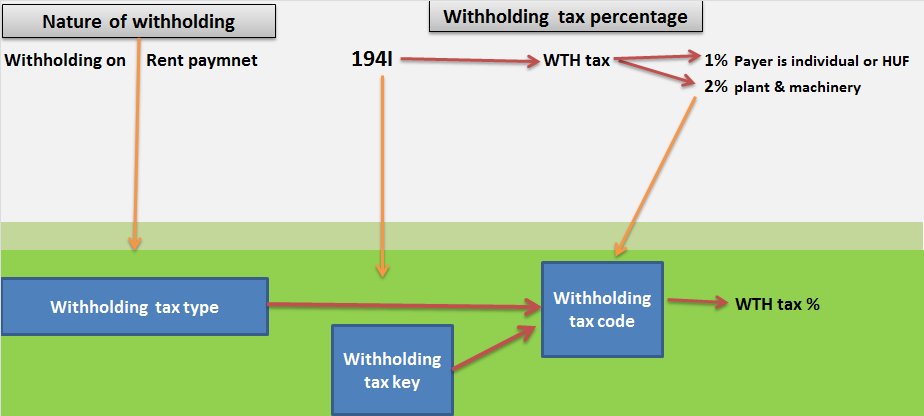

Let’s put above concepts together and try to understand withholding tax configuration in sap

- WTH tax type is created: WTH tax type represents nature of withholding tax e.g. withholding on rent, withholding on payment to contractor etc. It has got control fields which control the way withholding is applied.

- WTH tax key might be created: Few countries require that tax reports should have official WTH tax key along with WTH tax details.

- WTH tax code is created: WTH tax code captures the WTH tax percentage that is to be applied on base amount.

How GL account for posting tax amount is picked automatically.

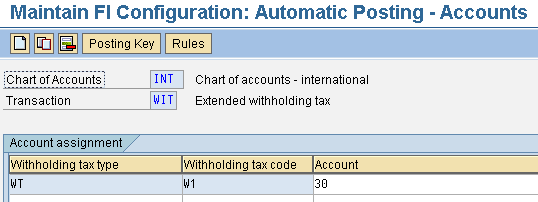

GL account for posting WTH tax amount can be picked on the basis of WTH tax code or WTH tax type or a combination of WTH tax type and WTH tax code.

Combination of WTH tax type & WTH tax code is assigned GL account for posting WTH tax amount.

Vendor details relevant for withholding is maintained in vendor master

Below information which is relevant for withholding is maintained in vendor master:

→Applicable withholding tax type & tax code

→If vendor is liable for withholding tax or not? Some vendors may not be liable for WTH tax.

→Vendor belongs to which recipient type? Applicable WTH tax code depends upon vendor recipient type also. Vendor is company or not plays role in deciding applicable WTH tax code.

→Vendor exemption details: Vendor may be exempted from certain percentage of WTH tax.

→Exemption certificate number if any: If vendor is exempted then vendor must have received an exemption certificate number.

→Validity dates of exemption certificate: Exemption valid from date and exemption valid to date

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING