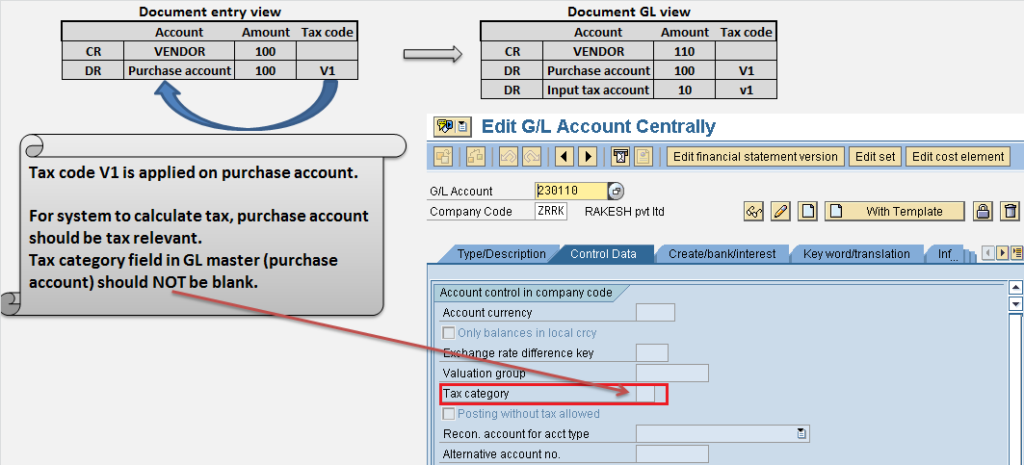

If transaction is tax relevant, then accounting of tax also needs to be done. Accounting document should incorporate tax accounting (tax calculation & posting) also.

When a tax relevant document is posted, tax code is entered in the document for tax calculation & posting.

Example:

Transaction: Purchase goods worth 100 from vendor and tax rate 10%.

Assume V1 is input tax code for 10% input tax.

Then for system to calculate tax, V1 needs to be entered against purchase account.

Prerequisite is purchase account should be ready to accept tax code or purchase account should be tax relevant. A GL account is made tax relevant by using field tax category in GL account master.

If tax category field in GL master of purchase account is left blank then purchase account is not relevant for tax. Hence tax calculation will not happen.

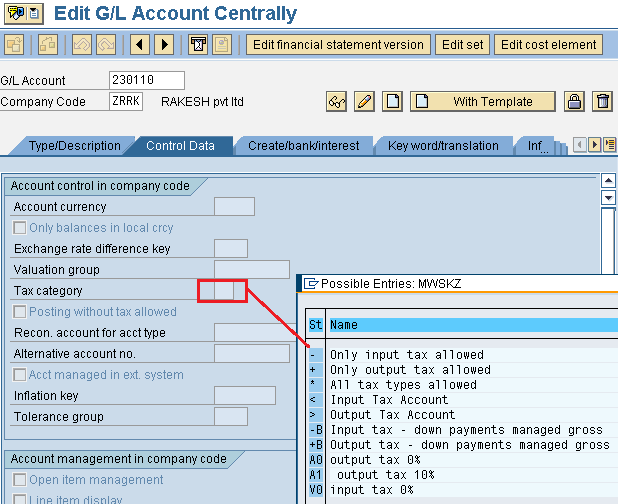

What to maintain in tax category field in GL master?

As we can see in picture, tax category field can have many values. How to decide what value to maintain in GL master?

Every GL account is created for specific purpose:

Purchase account might be created for accounting of purchase transaction.

Revenue account might be created for accounting of revenue transactions.

From the nature of transaction that will be posted in GL account, you know what nature of tax (input tax or output tax) is going to be involved.

→If you know, purchase account is always going to have input tax only. Then select tax indicator “- only input tax allowed”. If someone uses output tax code then error will popup saying only input tax is allowed for the GL account.

→If revenue GL account is always going to have output tax only, then it makes sense to maintain tax category “+ only output tax allowed”.

→If both input tax & output tax may involve with GL account, then it makes sense to maintain tax category “* all tax types allowed”.

Posting without tax allowed

Suppose tax category in GL master of purchase account is not blank, it means purchase account is tax relevant account.

Hence whenever you try to post to purchase account, system will ask for tax code. Without entering tax code, document will not get posted.

But what if you want to post to purchase account without having tax involved, then probably your requirement is if tax code is provided then calculate tax and if tax code is not provided then post the document without tax.

Hence you should be able to post to purchase account with or without tax code.

This is achieved by selecting the field posting without tax allowed.

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING