To understand how lockbox helps organization to manage collection from customer (account receivable). We need to understand the challenges faced by accounts receivable department in collecting payments from customer.

Challenges in collection from customer:

Customer makes payment to company by issuing check. Everyday company receives large number of chec from various customers. Checks are sent to bank for encashment. Someone has to carry checks to bank. Company has to keep track of all the checks. Once checks are encased, finance department has to reduce account receivable and increase the bank balance in account books.

This process leads to

Delayed cash flow:

Cash is available for use only after check is encashed in bank. Collecting check from customer and then sending to bank for encashment consumes few days. During these days money is not available to be used by bank.

Cumbersome tracking of checks:

Increase in number of cheques increases the difficulty in tracking.

Multiple visits to bank

Need for lockbox

The problem of delayed availability of money for use by company can be solved if customers send check directly to bank. Bank encashses the check and informs the company about received payment. Company reduces account receivable and increases bank balance in account books. This process of collection management ensures better cash availability, better & faster tracking, less visit to bank.

This process of collection management is enabled by lockbox.

What is lockbox?

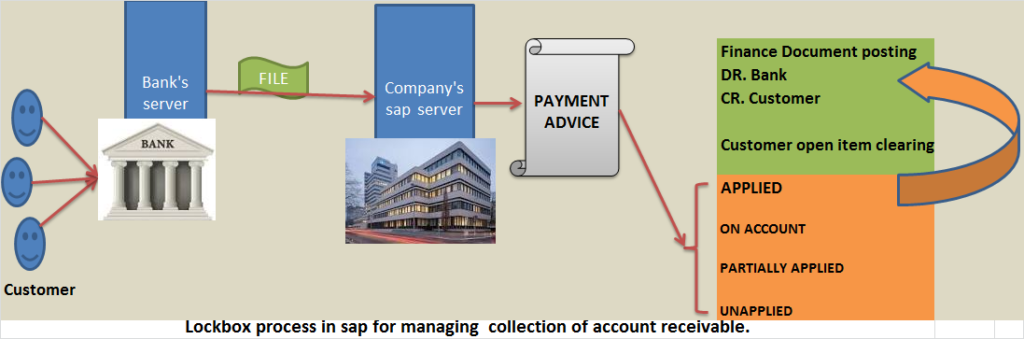

- Company opens lockbox facility with bank.

- Company informs its customers to send cheques directly to bank. Customer provide below remittance information along with cheque, Invoice number against which customer is paying, Invoice amount, Text note

- Bank prepares a file called as lockbox file which is sent to company.

Lockbox file contains below information

Customer number, invoice number, invoice amount, cheque amount etc.

File is prepared in a specific format agreed between bank and company. Normally file format is BAI or BAI2. - Company receives the lockbox file and loads the file into sap server. Program RFEBLB30 reads the file and creates payment advice which has information like customer number, invoice number and payment amount.

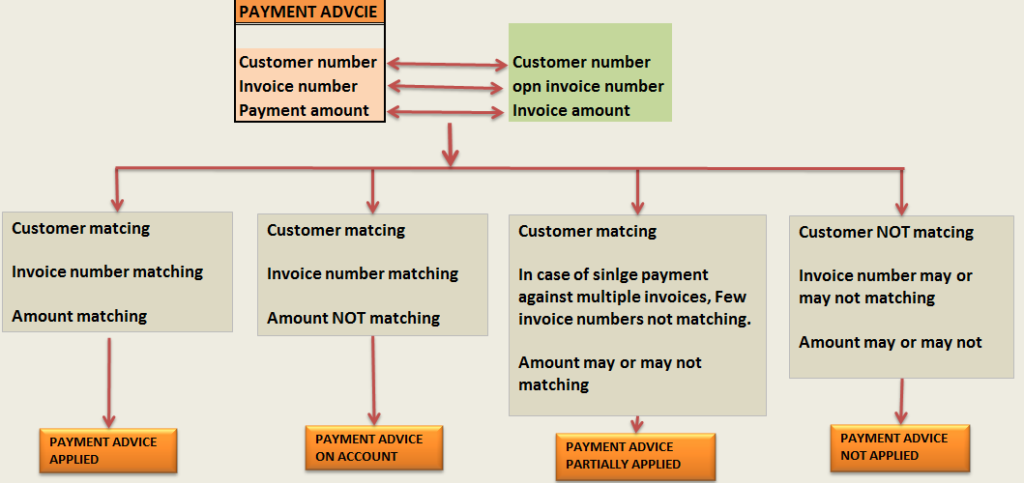

- Information in payment advice is matched against customer number, open invoice number and invoice amount.

There can be four below scenarios:

Scenario 1

If information in payment advice is matching with customer number, open invoice number and invoice amount, then payment advice is applied successfully.

Below accounting entry is generated and customer open item is cleared.

DR. Bank clearing account

CR. Customer

Once payment advice is successfully applied, payment advice gets deleted.

Scenario 2

Customer number and invoice number is matching but amount is not matching. Then payment advice remains in status on account.

Later on during post processing stage, correction is made in payment advice and applied. Payment advice gets processed successfully leading to open item clearing and generation of accounting entry.

Scenario 3

In case when customer makes a single payment against multiple invoices, it may happen that same invoice number are matching but few invoice numbers are not matching. Then status of payment advice is in partially applied.

During post processing, correct in payment advice is made and payment advice is applied successfully.

Scenario 4

Customer number itself is not matching. Then status of payment advice is unapplied.

Correction is made during post processing and then payment advice is applied.

When bank encashes the check, bank sends another file (Electronic bank statement or EBS) to company. Company loads the file on the server and below posting happens.

CR. Bank clearing account

DR. Main Bank account

Upon processing of EBS file, clearing account is cleared and main GL account corresponding to bank account is posted. So that balance in company accounts books can be reconciled with actual balance in bank account.

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING