As directed by tax authority:

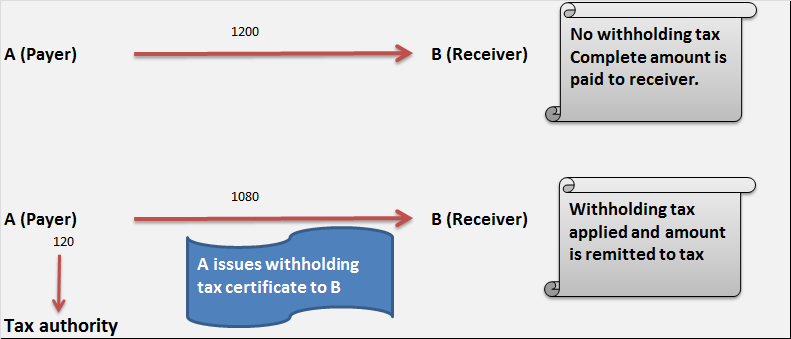

Company is supposed to withhold certain portion of gross amount before making payment to receiver (payee).

Company is supposed to issue WTH tax certificate to payee after deducting withholding tax amount.

Company is supposed to remit the deducted tax amount to tax authority before specific date (normally before 7th of next month).

Company is supposed to file withholding tax returns to tax authority by providing details in specific format.

Challenges in managing withholding tax

Tax authority may penalize company heavily, if company defaults in fulfilling its obligation:

→If company forgets to deduct withholding tax amount while making payment to payee

→If company does not remit the collected WTH tax amount to tax authority before specified date.

→If company fails to file WTH tax returns to local tax authority with all relevant details before specified date.

→If company provides wrong data to tax authority

Failing in any steps will invite very heavy penalty from tax authority. Failing in fulfilling obligation is not an option for the company.

Hence company has to make sure that correct WTH tax is deducted before making payment to payee. For each & every transaction, WTH tax amount along with other transactions detail need to be recorded properly. For filling withholding tax returns, information of WTH tax along with other details of transactions needs to be put together. Company cannot afford to breach date specified by tax authority for filling returns hence ability of produce accurate tax report as quickly as possible is crucial.

With increasing number of transaction in the company, managing WTH tax (recording & reporting) manually becomes very difficult.

Company needs to automate the process of recording & reporting WTH tax as much as possible. This is where sap comes in, sap helps in automating the process and reduces manual intervention at the same time increases data accuracy and speed of tax report generation.

Configuration in sap is done in such a way that whenever a transaction is posted, withholding tax amount along with other transaction details is recorded. Withholding tax reports can be fetched in sap at any given point of time.

Process of generating withholding tax certificate can be automated as well.

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING