What is product costing in sap?

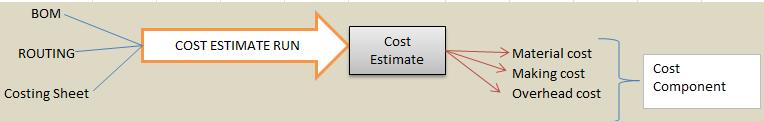

Estimating the cost of a product is referred as product costing. Now in order to estimate cost of any product, below information is needed

- What materials and in how much quantity are consumed in producing finished good? List of all the materials which are consumed is referred as Bill of Materials (BOM).

- How much is the making cost in producing finished product? Making cost comes from activities that are being performed on materials to produce finished product. Each and every activity which is performed has cost associated with it. Hence if we calculate cost of each activity and add it up, we will arrive at making cost of finished product.

Each activity might have different cost associated with it. Hence making cost of finished product depends upon which activity is performed in how much quantity in producing finished product. Hence, adding up the cost of various activities in order to arrive at making cost of finished product is referred as Activity Based Costing.

Maintaining the list of all the activities and their respective quantities which are performed in producing finished product is referred as Routing.

How much is the overhead cost in producing finished product. Overhead cost is the indirect

cost which is involved in producing finished product. Example of overhead cost Electricity, Wifi, cleaning cost, telephone bills etc.

Let’s say that over the years of experience, business has learned that overhead cost is normally 1% of material cost and .5% of making cost. Hence overhead cost is calculated by applying certain % on material cost and similarly on making cost.

Hence for calculating overhead cost, we can use a formula which will calculate overhead by applying certain % on material cost and certain % on making cost. This kind of formula is referred as Costing Sheet.

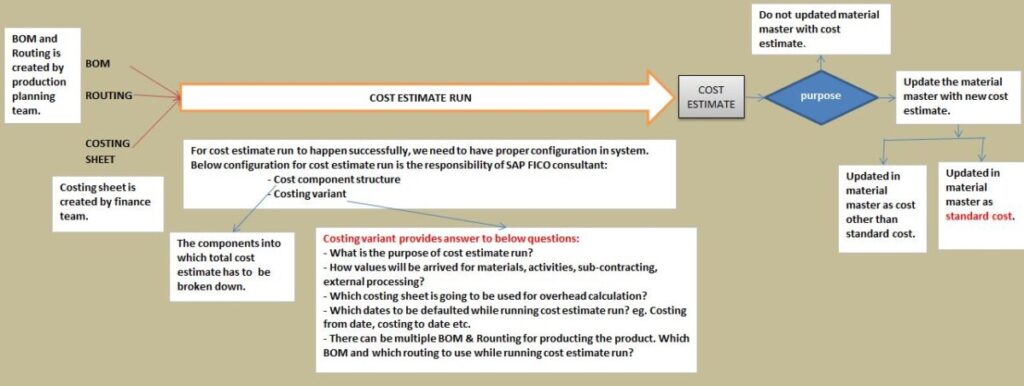

Hence to estimate cost of a finished product, we need to create BOM, Routing and Costing sheet.

Material is created by SAP MM team.

BOM and Routing is created by SAP PP team

Costing sheet is created by finance team.

Let’s say Bom, Routing & Costing sheet is created. Then in order to estimate the cost of finished product, we need to execute cost estimate run. The estimate run picks up the list of materials consumed from BOM, picks up the list of activities from Routing and calculates overhead cost using Costing sheet.

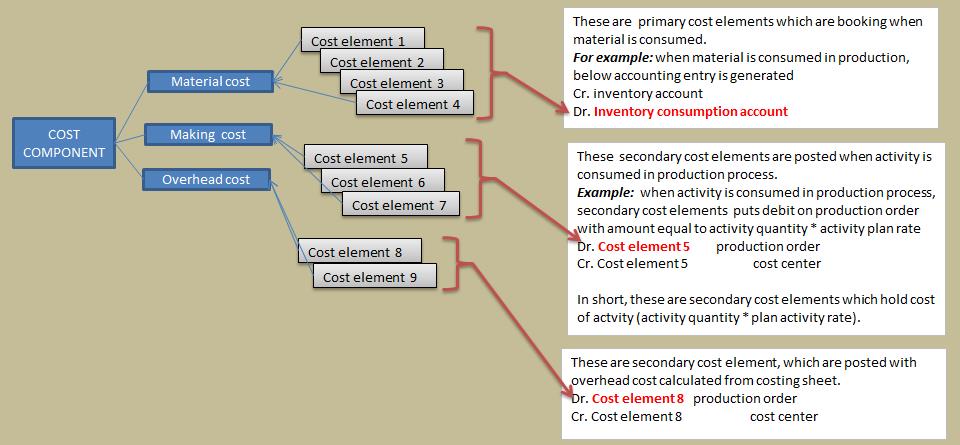

Output of cost estimate run is, estimate cost of finished product divided at lower level. Total cost of finished product is broken down at lower level for analysis purpose. These broken down lower level of Cost is referred as Cost Component.

In our example, total cost can be broken down into lower levels (cost components) like Material cost, Making cost & overhead cost. These cost components add up to make cost of finished product.

Defining the cost components into which total cost estimate is to be broken down is referred as Cost Component Structure.

Let’s understand the above concepts along with example:

Let’s try to do cost estimate for finished product “CARROT Halva”.

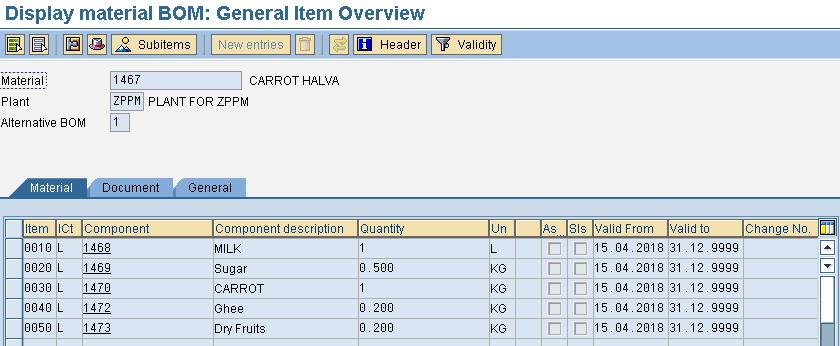

Suppose for producing 1kg of Carrot Halva, estimated material consumption is Milk (1 liter), Sugar (.5 kg), Carrot (1kg), Ghee (.2kg) and Dry fruits(.2 kg).

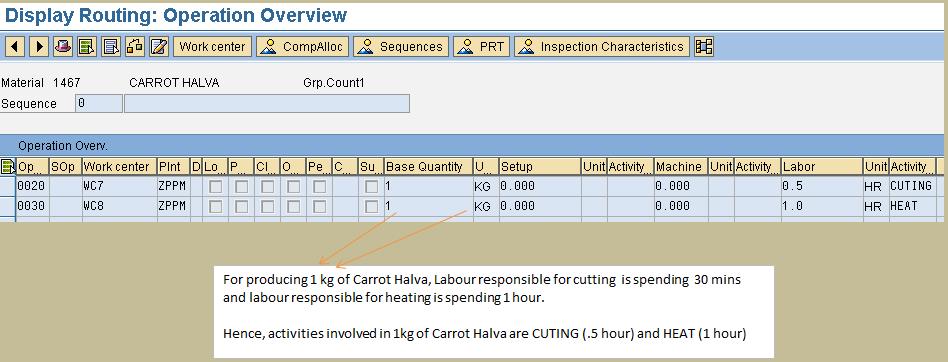

Activities involved for producing 1 kg of Carrot Halva are Cutting (crushing the carrot) and then heating the material for cooking.

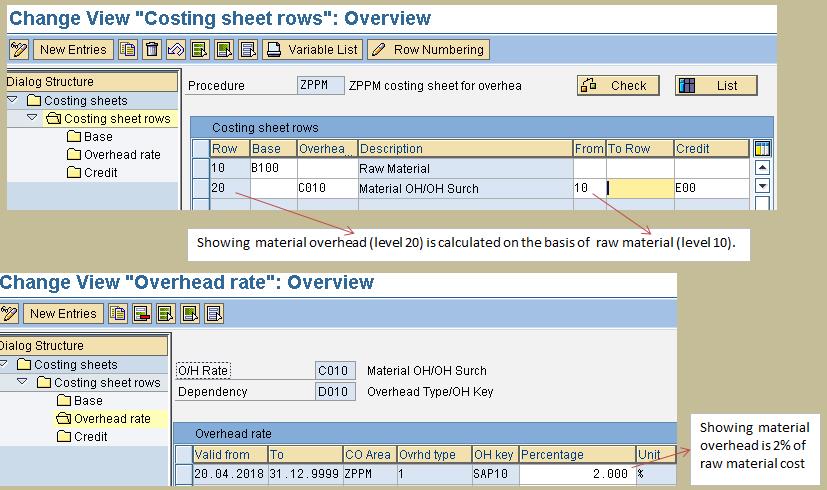

Overhead is 2% on raw material cost.

Above picture shown BOM for 1 kg of finished project “Carrot Halva”.

Above is routing

Above is the costing sheet showing material overhead is 2%

How costing sheet is defined and used will be covered in detail in later articles. As of now let’s just say that material overhead is 2% on raw material cost.

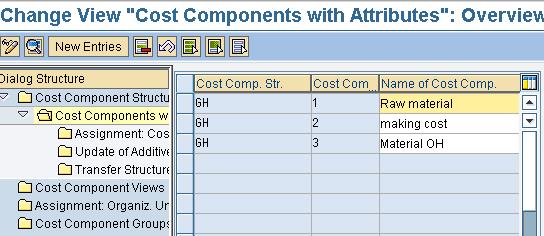

Below screenshot showing cost component structure

Above cost component structure ‘GH’ showing total cost is to be broken down into three components namely Raw material, Making cost and Material overhead

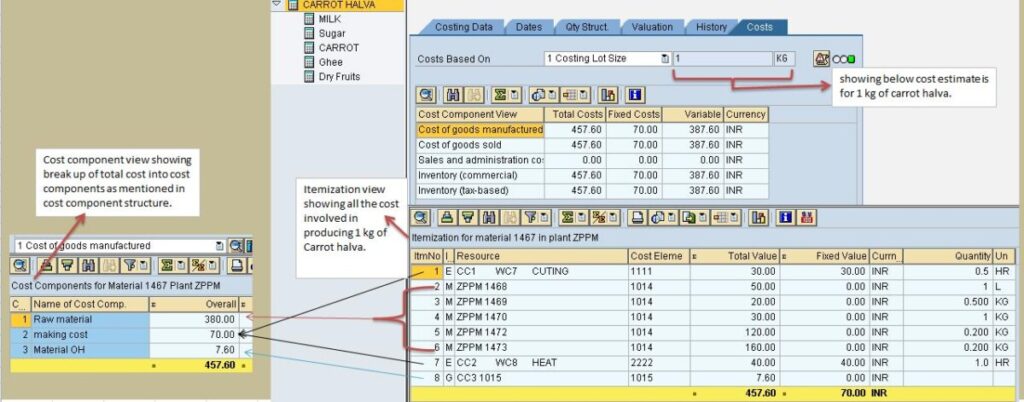

Below is the output of cost estimate run:

Above screen showing, total estimated cost of producing 1 kg of carrot halva is 457.6 INR.

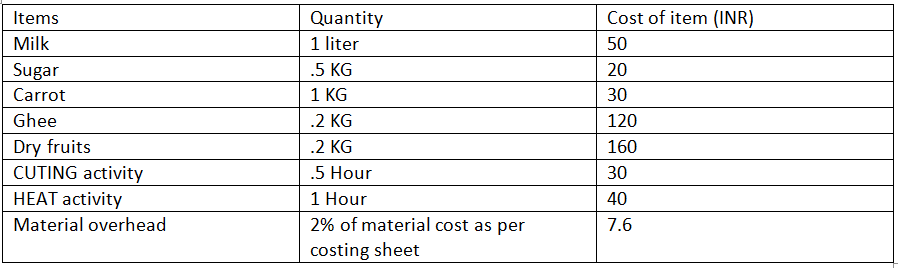

Cost of items involved is as shown below:

Let’s focus on work of SAP FICO consultant in product costing.

As discussed above, cost component structure is created by finance team.

As shown above, different cost accounts need to be mapped to respective cost components. As a result when cost estimate is run, cost is clubbed in respective cost components as specified in cost component structure.

As discussed above, costing variant is maintained by FICO consultant. Let’s understand what is the use of costing variant? Costing variant provides answer to below questions:

What is the purpose of cost estimate run?

How values will be arrived for material, activities, subcontracting and external processing?

Which costing sheet is going to be used for overhead calculation?

Which dates to be defaulted when running cost estimate run? E.g. Costing from date, costing to date etc.

There can be multiple BOM and multiple Routing. Which BOM and Routing to use when running cost estimate run?

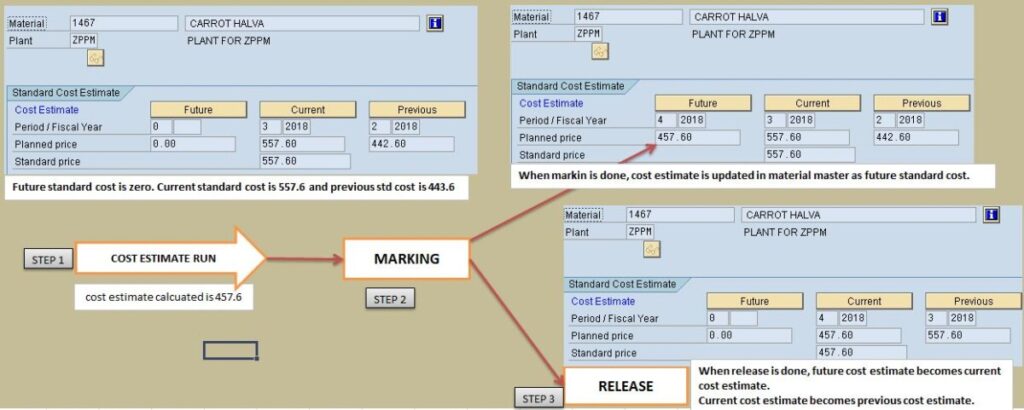

How cost estimate is updated in material master as standard cost?

Below steps to be executed to update cost estimate in material master:

- Cost estimate run:

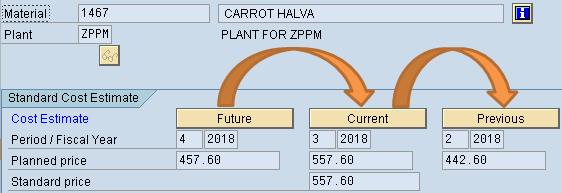

Run estimate run is executed so that cost estimate is calculated using costing variant. If cost estimate is calculate correctly (without any error), calculated cost estimate is saved. - Marking: Marking refers to updating calculated cost estimate in material master as future standard cost. As shown in above picture, as a result of marking future cost is updated in material master.

- Release: Release refers to making future cost as current cost estimate and current cost become previous cost.

What happens when estimated cost is updated in material master as standard cost?

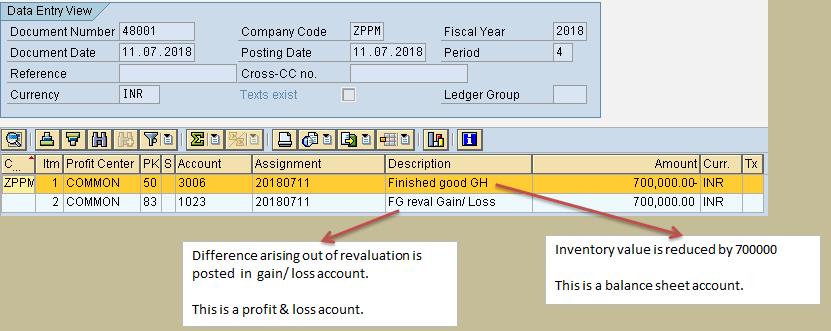

When new standard cost is updated in material master, existing inventory is revalued at new standard cost. The difference arising out of revaluation is posted (finance document) in account books.

Existing quantity of material 1476 is 7000

Previous standard cost was 557.6

Hence, inventory value = Quantity (7000) X Standard cost (557.6) = 3,90,3200

When release happen, future price is updated as current standard cost.

New standard cost is 457.6

New inventory value = Quantity (7000) X Standard cost (457.6) = 3,20,3200

Hence value of inventory is reduced by 7,00,000

As a result of revaluation, below document is posted automatically:

Since above document is posted automatically, hence system needs to be provided with GL accounts to be picked for posting. This account determination is done in T code: OBY6

What is the use of standard cost which is updated in material master?

Use of standard cost in purchase order:

When good receipt (GR) is done, then below document gets posted.

s you can see, any difference between purchase price and standard price is posted to price difference account. (Assuming material is maintained at standard price and not at moving average price)

If price difference account is posted with big value then it reflects that purchase department has procured material at significantly high price than it should have done. Hence, price difference account balance reflects efficiency of purchase department.

Finance controller runs report of price difference account every month and check if purchases are being made at reasonable prices.

This way standard cost is helping in cost controlling.

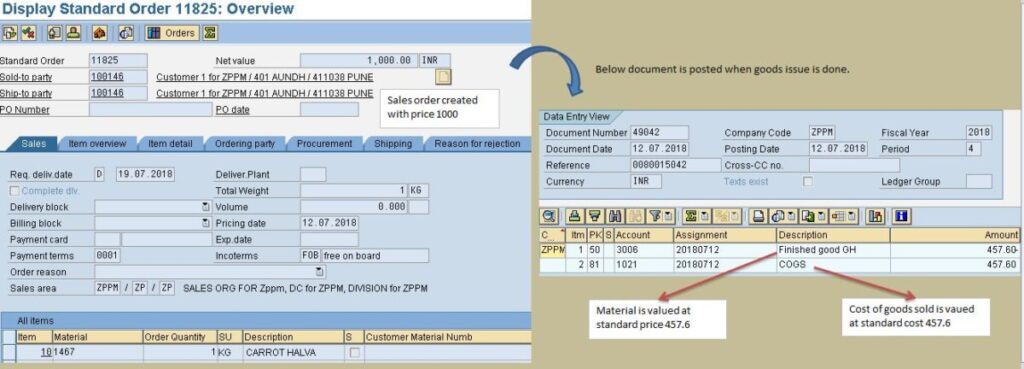

Use of standard cost in sales order:

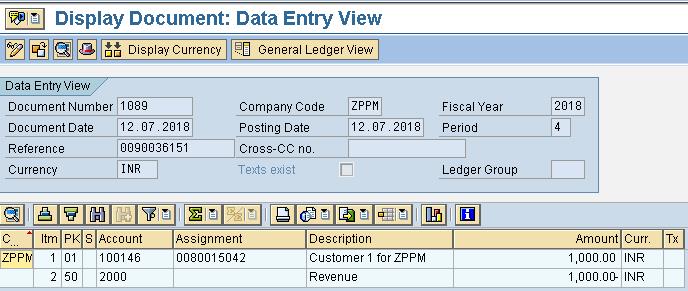

You can see above, material as well as Cost of goods sold (COGS) is valued at current standard cost.

Later on customer invoice is posted as below:

Revenue is booked 1000

COGS booked is 457.6

These help in arriving at profit margin (Revenue – Expenses)

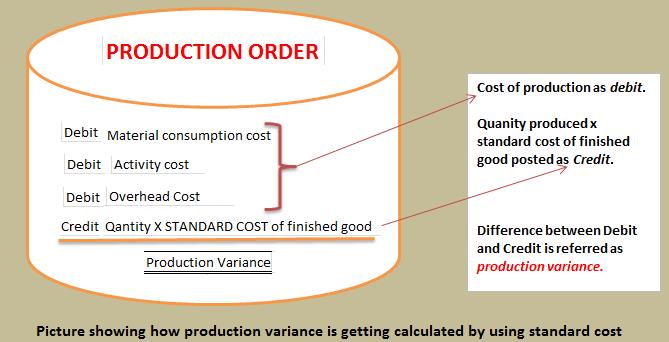

Use of standard cost in production order:

During manufacturing, cost is accumulated in production order and compared with target cost to check the efficiency of production. High production variance means cost of production is too high as compared to target cost. Production variance is important for cost control purpose. Production variance is getting calculated by using standard cost.

Best practices followed in product costing?

Standard cost is updated at start of the year for the whole year.

For all the materials which are maintained at price control “s”, standard cost is updated at the start of year and is valid for the entire year.

Cost valid from date: First day of the fiscal year

Cost valid to date: Last day of fiscal year

Only in case of fast moving consumer goods (where prices keep changing frequently), there is need to updated standard cost of material every month. (Valid from 1st day of month to last day of month)

Cost estimate run, Marking, Release is performed at different dates.

Let’s say new standard cost is to be updated from 1st day of the new fiscal year.

Consider a finished good which might be composed of hundreds of raw material. For finished good costing to happen, all the involved raw materials should have standard cost. Hence before we do standard costing of finished good, we should have completed standard costing of all the raw materials involved.

Thank You !

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING