SAP FICO stands for sap finance & controlling. Before understanding sap fi we need to understand the duties and responsibility of finance department in an organization.

Duties of finance department are:

- Book keeping/ recording accounting entry for day to day business transactions.

- Generating balance sheet and profit & loss statement

- Generating financial reports for legal/ statutory purposes e.g. tax reporting to government, reports for auditors etc.)

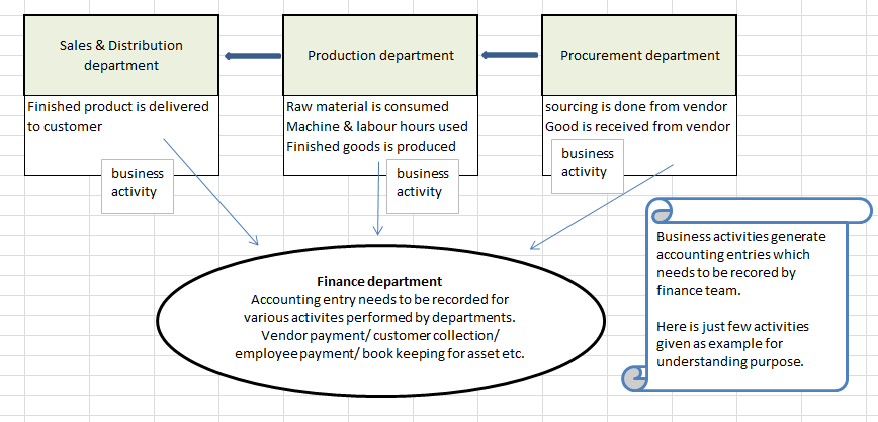

Now let’s understand what is meant by day to day activities in a business.

In order to understand activities in a business, we need to understand operations of a business. Every business will have customers to whom it will sell either services or product. Product/services may be purchased from outside or produced in-house. Purchase department has to purchase and supply to production department for production of finished goods. Distribution department has to deliver finished goods to customer.

Supplier/ vendor have to be paid.

Money from customer has to be collected.

Employees need to be paid.

Assets (machine/ vehicle/ building/ land etc.) need to be purchased or produced in-house. Depreciation of assets needs to be recorded.

Above picture depicts business activities generate accounting entry in finance.

Assume no IT system is used in organization, keeping track of activities and recording corresponding accounting entry becomes challenging. This challenge increases many folds by the fact that people are spread across geography. Improper and slow coordination between departments lead to slow business cycle. Manual recording of accounting entries increases the chances of in-accurate data being recorded.

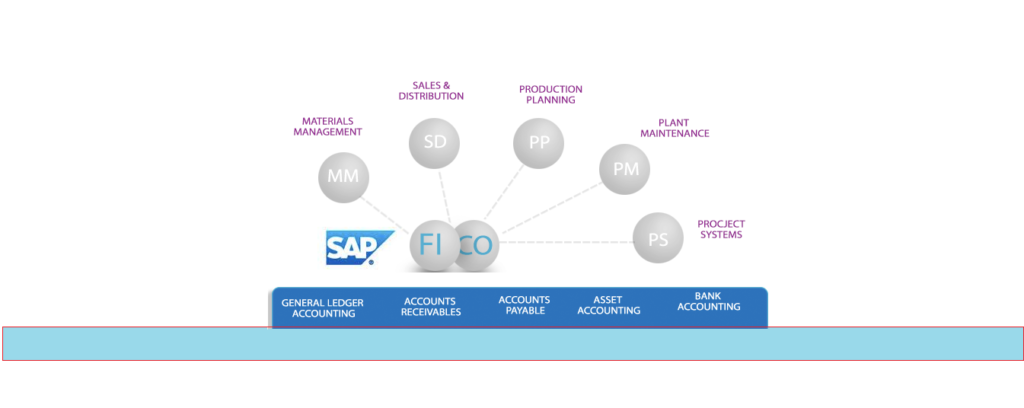

Sap finance module deals with all the activities of finance department. At the same time overcomes the challenges of department’s coordination and manual recording of accounting entry.

Most of the manual activities are automated. Less manual intervention ensures more accurate data. Real time coordination between departments (sap fico module with other modules) ensures all affected parties are updated simultaneously.

Sap fico module helps in generating faster financial reports e.g. balance sheet/ profit & loss statement/ tax reports for tax authority/ reports for auditors etc.

Above picture depicts coordination between various modules and FI module.

Sap finance module is composed to several sub modules. Each sub-module is designed to handle specific business activity and corresponding accounting entry.

-General ledger accounting

-Account receivable

-Accounts payable

-Asset accounting

-Bank accounting

-Tax accounting

Sap CO stands for sap controlling.

Sap finance & sap controlling modules are placed close and overlapping (as shown in above picture) because sap finance and controlling modules are very closely integrated. A business activity often generates accounting entry in finance and corresponding entry in controlling as well.

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING