Before discussing about production order confirmation, Let’s start with how to read a production order in sap.

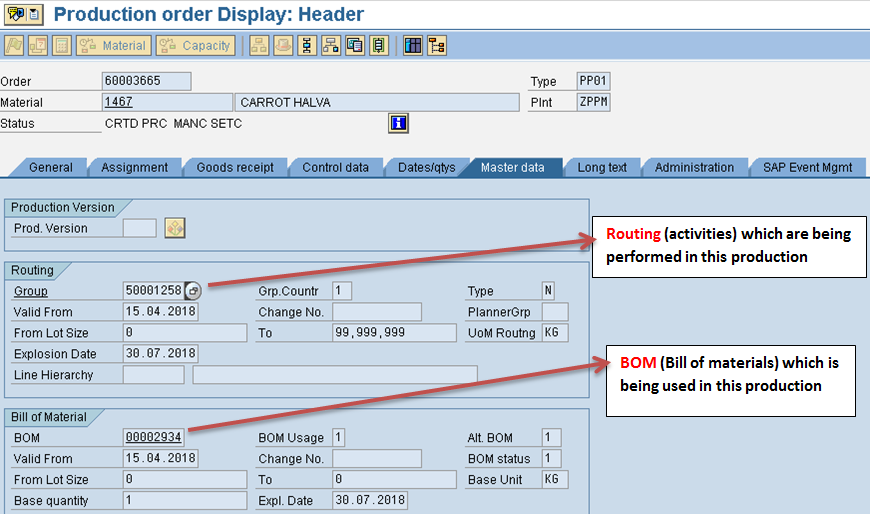

BOM, Routing and costing sheet is going to be used in production cost calculation.

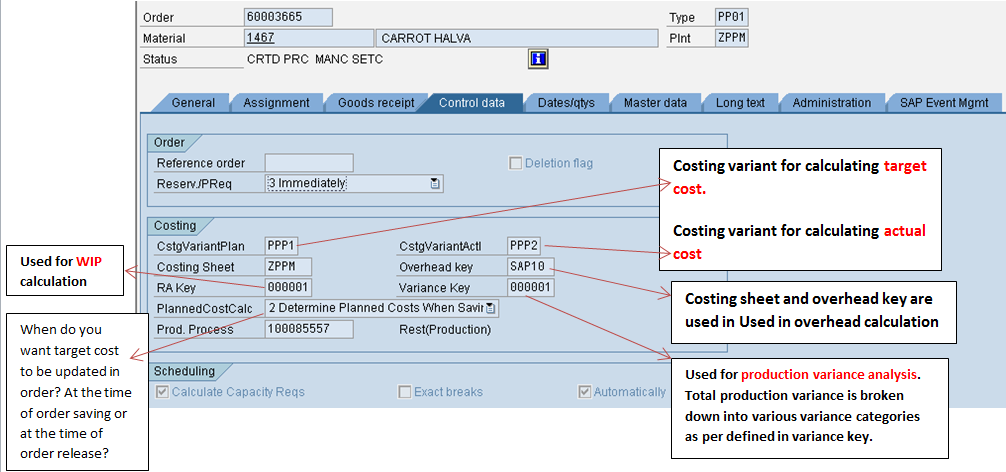

RA key: Result analysis key is used for WIP calculation and posting.

Variance key: variance key is used for analysis of production variance. Production variance is broken down in variance category for analysis purpose. Variance key defines the list of variance categories for analysis purpose.

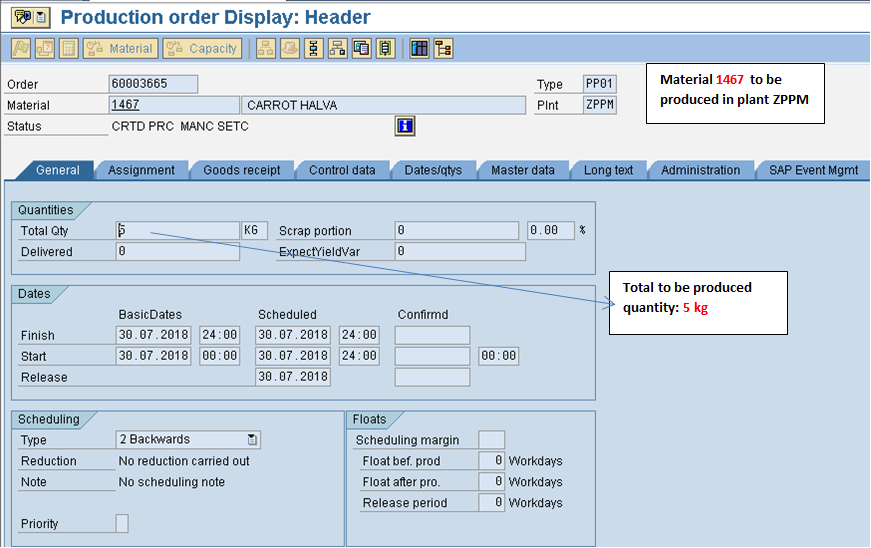

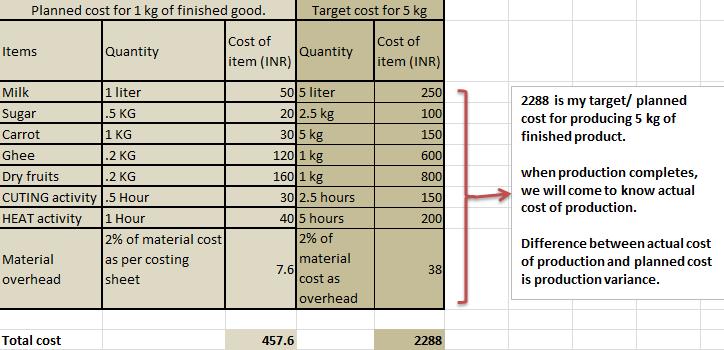

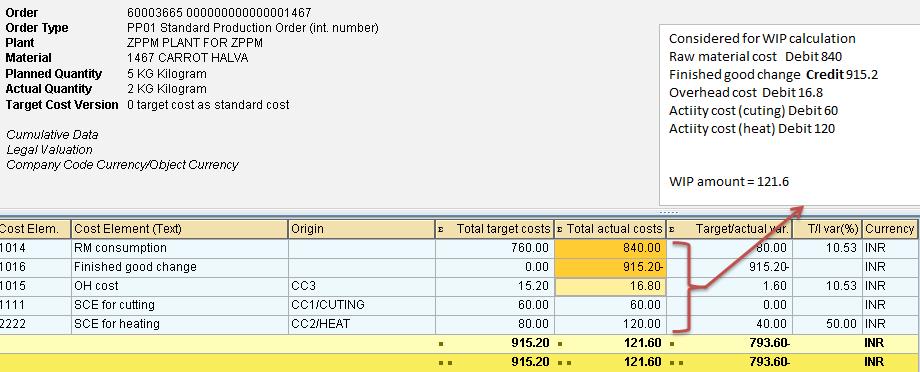

As per above production order, we will be producing 5 quantity of finished product. Below is our cost projection, this cost expectation can also be referred as planned cost or target cost.

Above picture showing target cost for producing 5 quantity of finished good.

But during actual production, raw materials consumed quantity might be different than planned quantity. Similarly, activities actual quantity might be different from planned quantity. Hence actual cost of production will be different from planned/ target cost of production.

Production order confirmation

As per production order, 5 quantities of finished goods are to be produced. I am assuming that production is going for couple of days. At the end of every day, production manager is supposed to update below information in sap:

What quantity of finished goods is produced?

Which raw material and in what quantity is consumed while producing the said quantity of finished good?

Which activity and how much is performed while producing the said quantity of finished good?

Updating above information in production order is referred as production order confirmation.

Once production order confirmation is saved, sap calculates cost involved (by valuating raw materials consumed and activities performed as per actual costing variant).

Suppose, production manager confirms below:

Finished goods produced 2 kg

Ram materials consumed: Milk (3L), sugar (1kg), carrot (3kg), ghee (.4kg) and dry fruit (.4kg)

Activity performed: Cutting (1 hour), heating (3 hours)

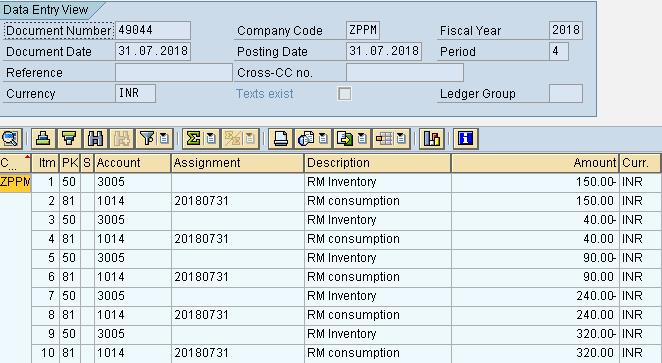

As a result of above confirmation, below accounting document gets posted.

Accounting document for Ram material consumption (GL account picked from OBYC configuration)

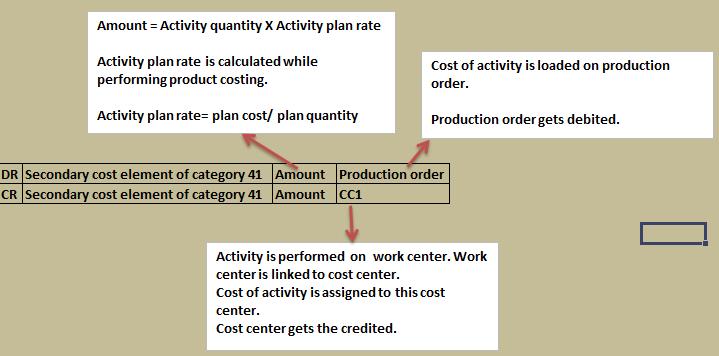

Below controlling document is created when activity is confirmed:

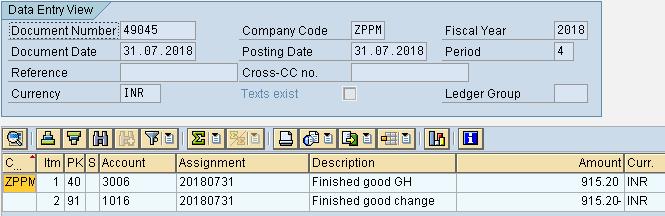

Below is the financial document posted when 2 kg of finished goods is confirmed/ produced.

Once above confirmation is performed in system, sap will calculate and update actual cost. Till now actual cost is incurred only for producing 2 quantities of finished good.

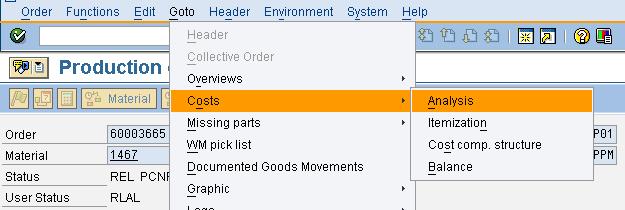

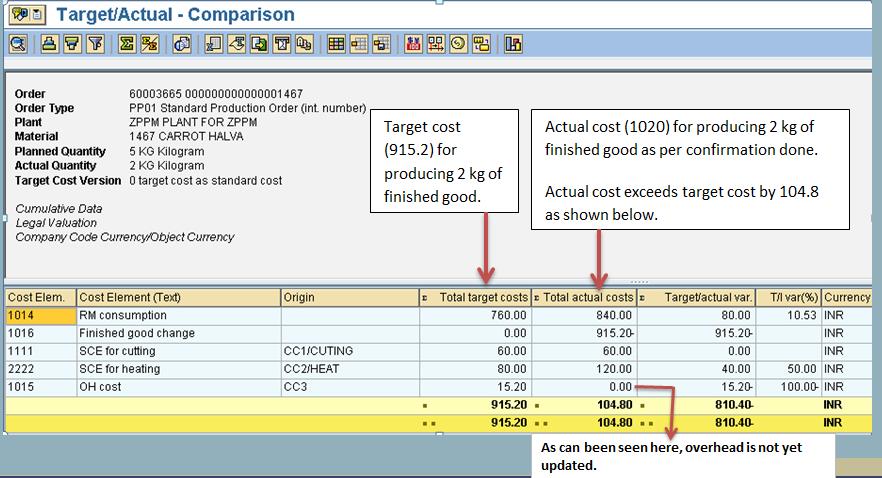

Now let’s check the cost in production order.

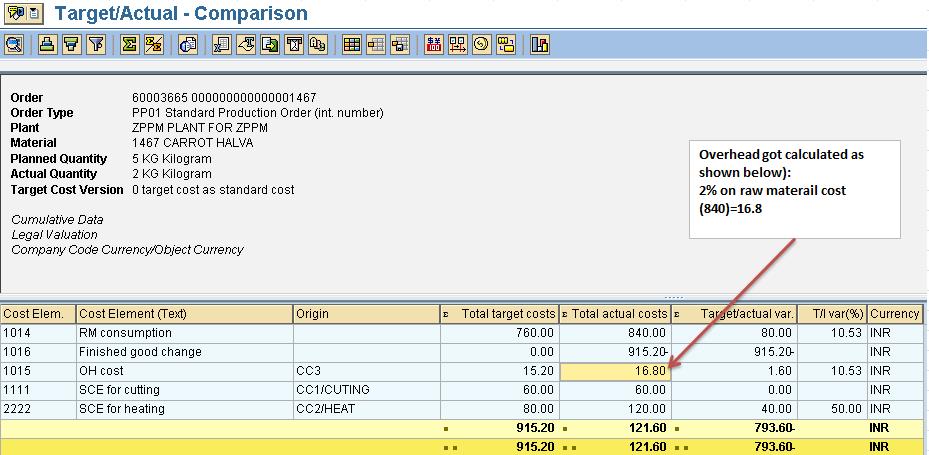

For overhead calculation, we need to perform transaction KGI2

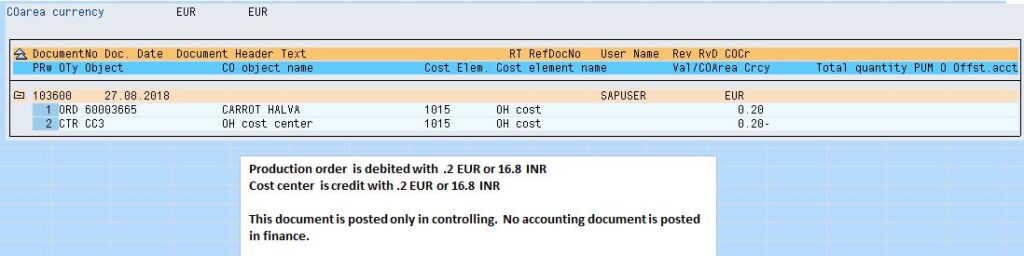

Overhead cost is calculated as per costing sheet. Overhead cost should be added in cost of production. Below financial document gets posted

Cost element 1015 used for posting above document is maintained in costing sheet.

Now suppose month end has come and this production order is still under production process and not yet completed. (Out of 5 ordered quantities, till now only 2 quantities is produced)

At month end, balance sheet needs to be finalized. Balance sheet needs to report real position of the company’s assets and liabilities as on date. Hence how do we handle this production order which is still under process and not yet completed?

Inventory which is produced is reported under balance sheet as inventory under current asset. In-process production order is reported under balance sheet as work in progress (WIP). Hence sap should have functionality to report WIP for production order which is not completed.

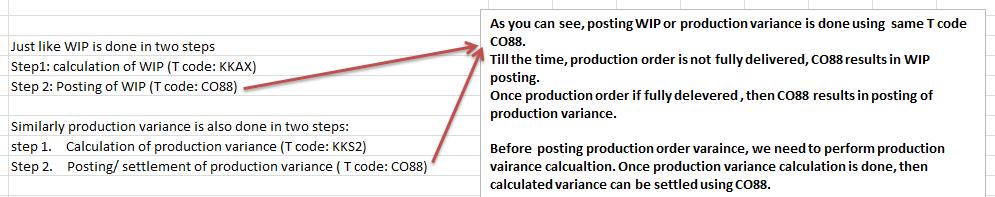

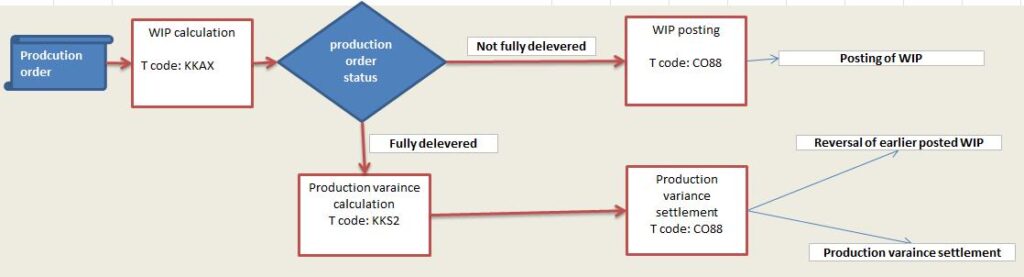

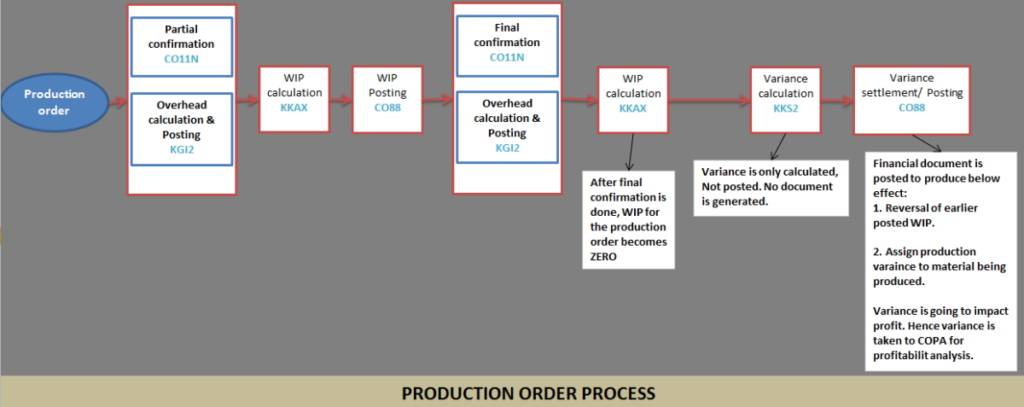

In SAP, WIP is handled in two steps

Step 1: Calculation of WIP amount

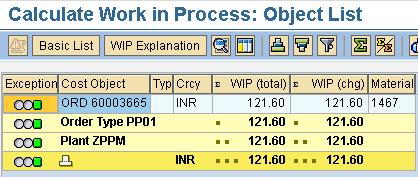

WIP Amount = total debit in production order – total credit in production order

For WIP calculation, T code is KKAX

When KKAX is executed, sap calculates debits and credits posted on production order and calculates WIP amount.

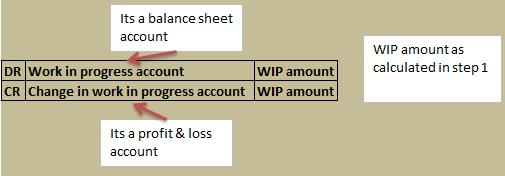

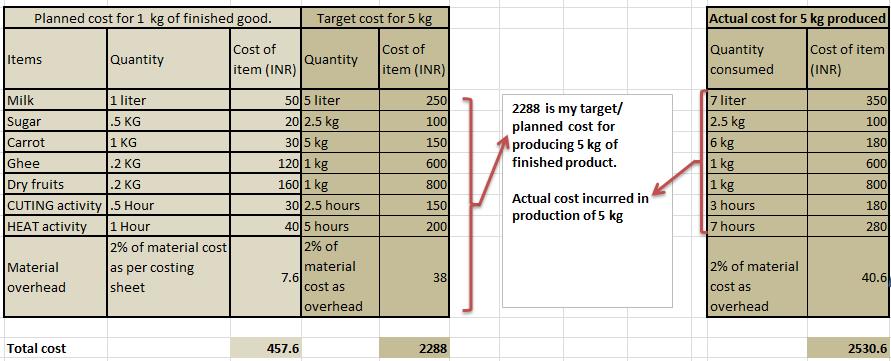

Step 2: Posting accounting entry of WIP (T code is CO88)

For posting above accounting entry system needs accounts (WIP and Change in WIP) and amount (WIP amount). Hence we need to tell sap two things:

How WIP amount is calculated?

– Out of so many cost components (raw material, overhead, activity cost etc.), which cost is to be capitalized (considered for WIP calculation)?

– Out of cost (which is considered for WIP calculation), what portion is to be capitalized and what portion is not to be capitalized?

– We need to maintain GL account for WIP and GL account for change in WIP.

Maintaining above information in sap can be referred as configuration for WIP.

In our example WIP of production order should be (121.6) a shown below

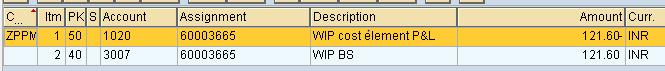

Let’s execute KKAX for WIP amount calculation:

Now, let’s post accounting entry for WIP by executing CO88

Now let’s suppose production continued in next month and has completed. Production manager confirms in sap that all 5 goods are produced and also confirms the quantity of ram material consumed along with activity hours consumed.

Hence production manager does production order confirmation for remaining 3 quantities in sap.

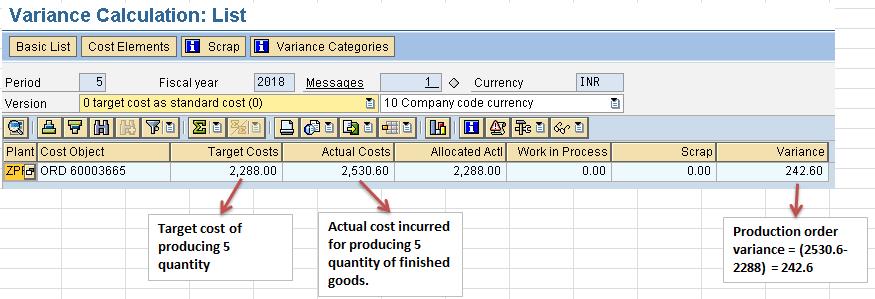

Hence, for producing total 5 quantities of goods, below is the cost involved.

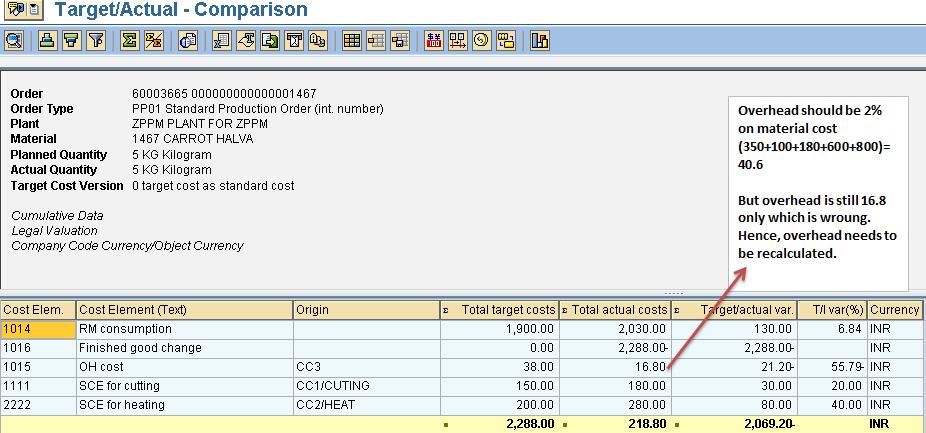

Same reflects in SAP as shown in below screenshot:

Overhead cost in production order is not revised automatically.

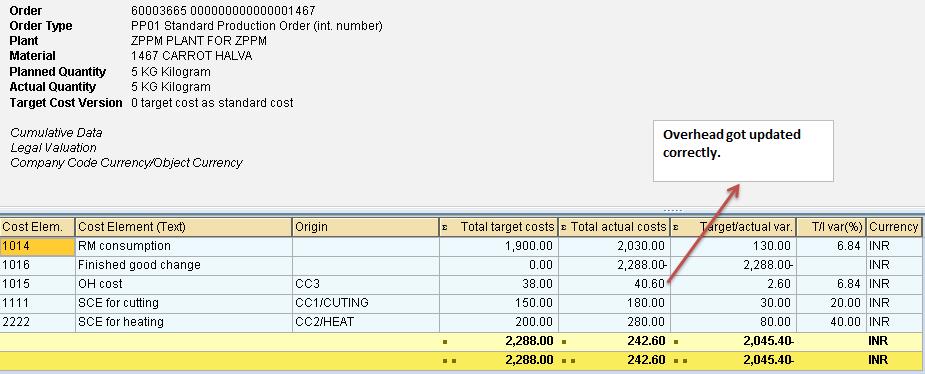

In order to recalculate overhead cost, we need to execute KGI2 again

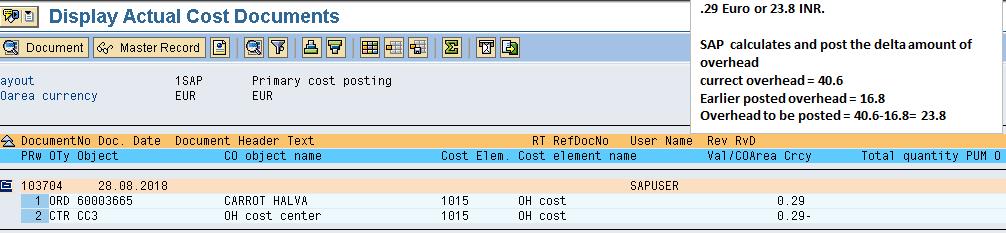

If you are interested in knowing what document got posted as a result of executing KGI2, then below document is posted only in controlling. No accounting entry is posted in finance.

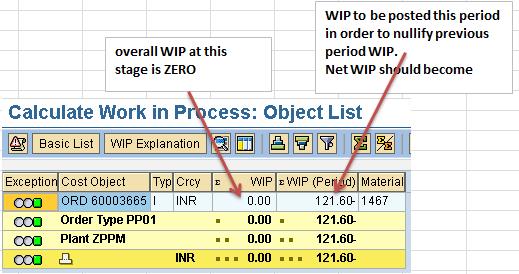

For this production order, production has completed. Like last month, this month also we need to perform WIP calculation. But since production for the order is already completed, hence there is no WIP or zero WIP.

In order to have zero WIP, already posted WIP has to be reversed.

Below screenshot after executing KKAX for WIP calculation:

WIP calculation is done. But we have not yet done WIP posting using CO88.

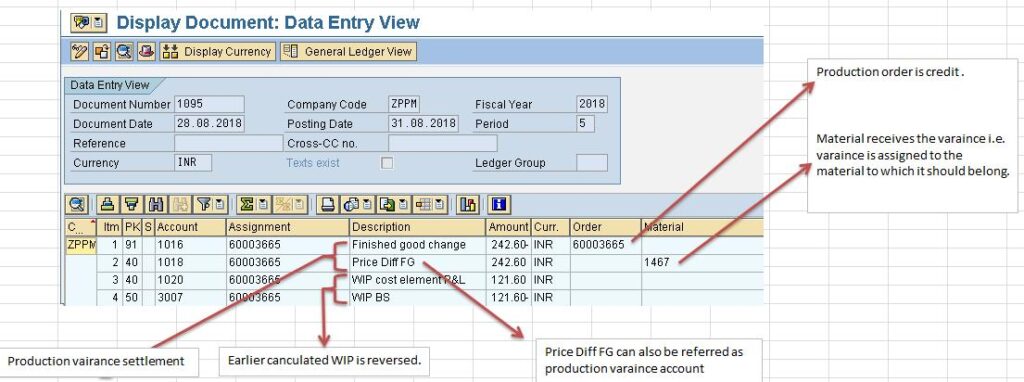

Earlier when CO88 was executed, WIP document was posted in finance. But now CO88 execution will result in

- Reversal of earlier WIP document: Net WIP has to be zero hence earlier posted WIP has to be nullified by posting reversal.

- Posting of production order variance: Earlier difference between debits and credits on the production order was treated as WIP. But now since production is completed hence this difference is treated as production variance. But before posting of production variance using CO88, we need to perform production variance calculation using KKS2.

Let us perform production order variance calculation (T code: KKS2)

Now let’s perform production order settlement using CO88

As a result of CO88:

– Earlier calculated WIP is reversed.

– Production variance is settled to material.

If profitability analysis is active then along with above financial document, variance is also taken to COPA for profitability analysis.

In this article, we tried to understand production order processing from finance point of you.

How COPA works will be explained in different article.

Let’s summarize what we learned

Production order processing from finance point of view

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING