Below article will help you understand the activities performed in sales process and relate it with order to cash cycle (OTC) in sap.

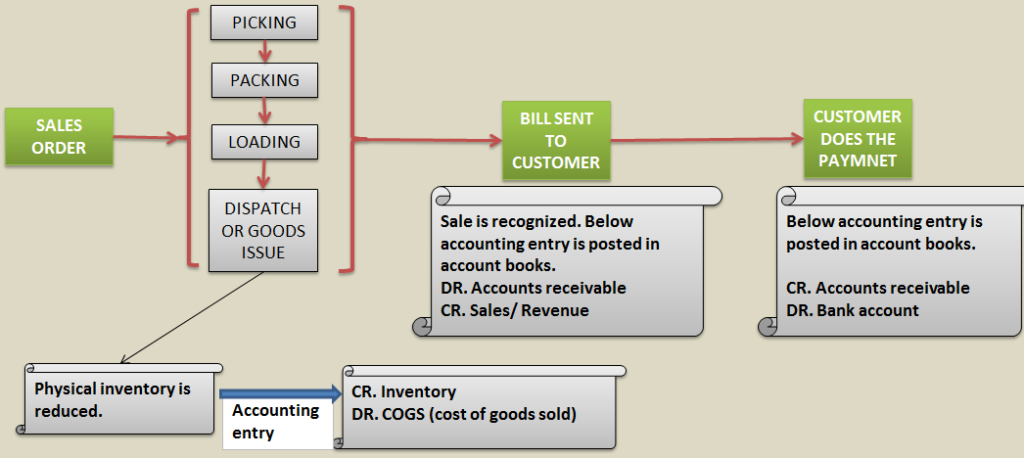

Every organization sales either product or services to its customers, company receives sales order from customer and does the delivery to customer as per agreed terms & conditions.

Company sends the bill to the customer. Since payment from customer is pending, the bill amount is registered as accounts receivable in the account books.

If payment by customer is getting delayed, then customer is notified that payment is pending for the bill. Initial notification to customer is sent by sending emails, if payment is getting delayed for long then printed hard copy of notice is sent to customer. At times, late payment charge is also applied.

When customer makes the payment, account receivable is reduced and bank balance increases.

Now let’s go a little deeper and try to understand what activities are performed inside the company in sales process.

- Sale team coordinates with the customer to finalize the deal. Sales team negotiates with the customer and finalizes the sales price. Sales order has information like “customer, material, Quantity, price, expected date of delivery, delivery address, and shipment terms like FOB (free on board) etc”.

- Company has warehouse or distribution center where goods are stored. Person in the warehouse or distribution center is notified to perform picking & packing of goods for delivery of the sales order. Picking refers to pulling inventory for order fulfillment. Packing refers to packaging the goods in suitable container or boxes.

- After picking & packing of goods, loading is performed. The packed goods are loaded on transportation vehicles (trucks, train, ships, air career etc.) Once packed goods are loaded, delivery is ready for shipment.

- Multiple deliveries which are intended to go to common location (address of delivery is nearby) are sent through same shipment. Logistics team is responsible for shipment.

- Goods are move out of company premises (truck loaded with goods leaves the company premises for delivery to customer), this is referred as dispatch or goods issue. Physical inventory of the goods is reduced and corresponding accounting entry is recorded in account books.

- Bill is sent to customer. Finance department records the sales and increases the account receivable in account books.

If payment from customer is getting delayed, then customer is sent notification (email or printed hard copy depending upon situation) to make payment for the bill. - When customer makes the payment, finance department reduces the accounts payable and bank balance increases.

As you can see, sales process starts with order (sales order) and ends with cash (customer payment), hence above cycle is referred as order to cash cycle or OTC cycle.

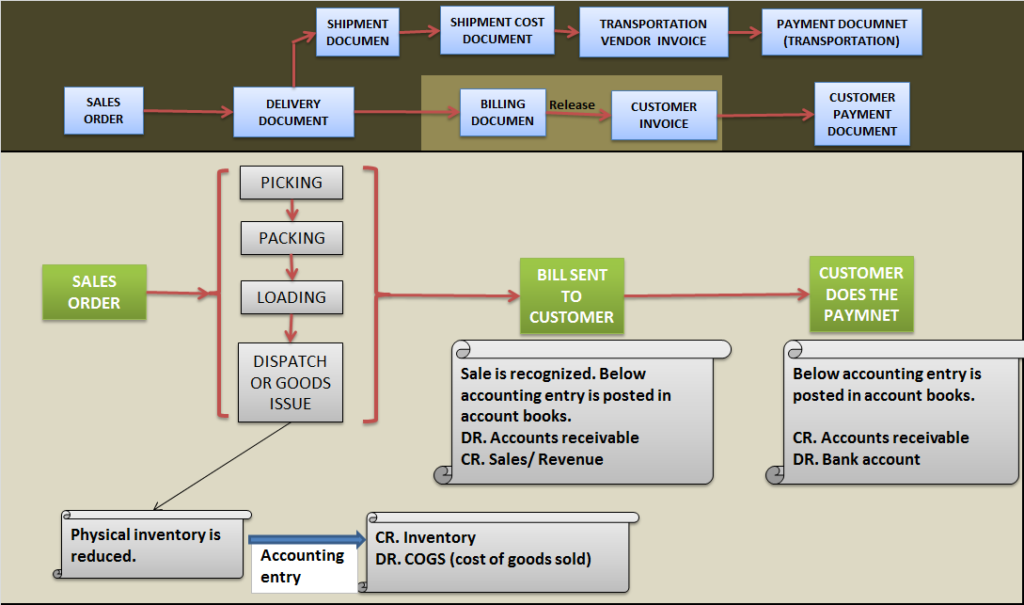

Let’s understand how sap helps in automating the above activities involved in order to cash cycle in a sales process.

Sales order is the starting point in order to cash cycle.

When company receives order from customer. Sales order is created which has below information:

Order type, sales area, customer, material, quantity, price, delivery schedule, delivery address, shipment terms etc.

Sales order is a sales document (not an accounting document). Sales order is used for the purpose of tracking the entire chain of sales activities.

All follow on documents like “delivery document, shipment document, customer billing document, customer invoice, customer payment document” are directly or indirectly linked t sales order.

Hence if you have sales order number, then history of entire chain of activities performed in the sales process can be found out.

Delivery document

Delivery document is crated with reference to sales order. It’s not an accounting document.

Delivery document is used by the team which is responsible for picking, packing, loading and dispatch of goods for the purpose of tracking these activities.

Depending upon delivery schedule (what quantity of material to be supplied on what date) maintained in sales order, goods are picked, packed, loaded and dispatched.

Delivery document can answer below questions:

What quantities of goods are picked?

Out of picked quantity of goods, how much quantity of goods is packed?

Out of packed quantity of goods, how much quantity of goods is loaded for transport?

What quantities of goods have been dispatched for order fulfillment?

Picking:

Pulling out materials from store

Packing:

Packing the picked materials into boxes or containers. Few materials like chemicals, glasses, cold storage products may require special packaging.

Loading:

Packed boxes/ containers are loaded on truck for transportation purpose.

Dispatch of goods issue:

Loaded truck leaves company’s premises for order fulfillment. Movement of material leads to automatic generation of material document as well as corresponding accounting document.

Material document has information: Material, Quantity & Movement type

Below accounting document get posted:

CR. Inventory

DR. COGS

Shipment document:

when goods are delivered, along with delivery a document is attached with the package itself. This document has information like material, quantity, weight, date, ship to address etc.

This document serves as a checklist when unpacking the delivery package. Shipment document basically tell you what is being delivered.

It’s not an accounting document.

shipment cost document:

Cost incurred in transportation of goods from company premises to customer address. Shipment cost can also be referred as transportation cost. Shipment cost document is created with reference to shipment document.

If shipment has multiple deliveries, then shipment cost might have to be distributed to individual delivery or delivery items.

It’s not an accounting document.

Customer billing document:

Billing document refers to the bill which is sent to customer for payment. Billing document has information of customer, material, quantity and price.

Billing document is created with reference to delivery document. Billing document is a sales document and not an accounting document.

Accounting document gets created when billing document is released.

Customer invoice:

When a billing document is released, automatically an accounting document gets created. Sales are recognized and accounts payable is booked.

DR. Account receivabl

CR. Sales or Revenue

Customer payment document:

Once customer makes the payment against the bill. Below accounting document gets posted:

DR. Bank

CR. Accounts receivable

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING