In this section we are going to understand below points about currency and exchange rate in sap.

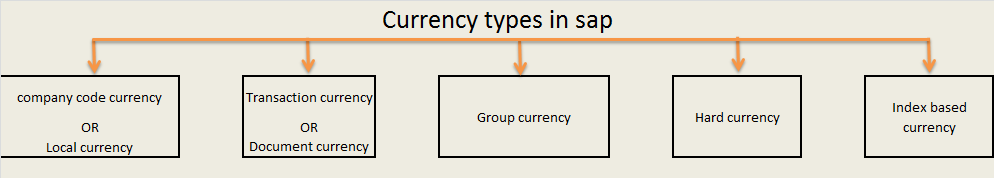

- Various currency types (document currency/ transaction currency, local currency/ company code currency, group currency, hard currency & index based currency).

- What is the need of having so many currency types in sap? How these currency types are configured in sap?

- What is exchange rate type in sap?

- What is the use of currency translation ratio and how it helps in maintaining exchange rate?

- What is the use of reference currency in maintaining exchange rate between currencies?

- How currency exchange rate is maintained in sap?

- In the end of this section, we are going to take an example which will help you understand how all above concepts are used in posting an accounting document in sap.

Document currency/ transaction currency, Local currency/ company code currency, Group currency, Hard currency and Index based currency

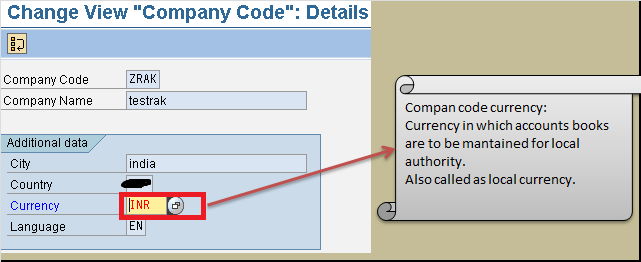

Company code currency or local currency:

Currency in which financial reports need to be prepared for local authority, e.g. Indian company code will have local currency INR.

Maintained at company code level. Maintained on the screen where company code is defined.

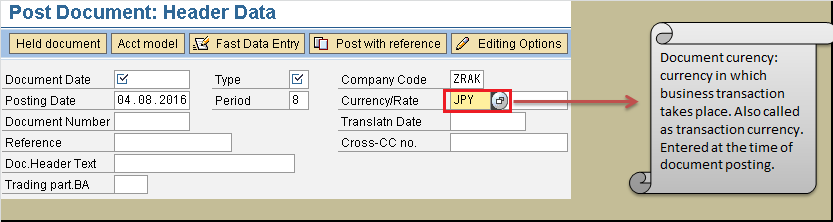

Transaction currency or document currency:

Currency in which business transaction takes place e.g. Indian company code doing export to European customer. Document will be posted in euro currency. Document currency is entered at the time of document posting.

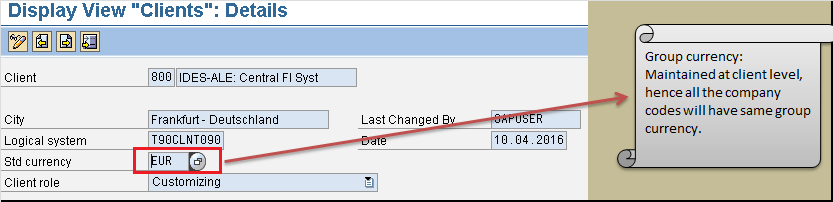

Group currency:

Currency in which group consolidation is going to happen, normally it’s the currency of the country where main company is located.

Maintained at client level

Hard currency:

Some countries which are economically unstable and have high inflation prepare their financial reports in currency other than company code currency. The other currency used is normally USD since it’s considered the most stable currency in the world. This other currency is referred as hard currency in sap. E.g. Mexico

Maintained at country level

Index based currency:

Few countries which have very high inflation need to prepare financial report in currency which can reflect a better picture of company’s health. Due to high inflation, judging the company’s performance in local currency becomes difficult hence index based currency might be used.

Maintained at country level

If currency types are configured for a company code: whenever a document is posted in the company code, balances will be updated in transaction currency as well as all the assigned currency types.

How to set up different currency types for a company code?

For document currency or transaction currency, no configuration is required. Other currency types (company code currency, group currency, hard currency & index based currency) needs to be configured in a company code.

In a ledger (leading or non-leading ledgers) maximum three currency types are allowed.

Leading ledger:

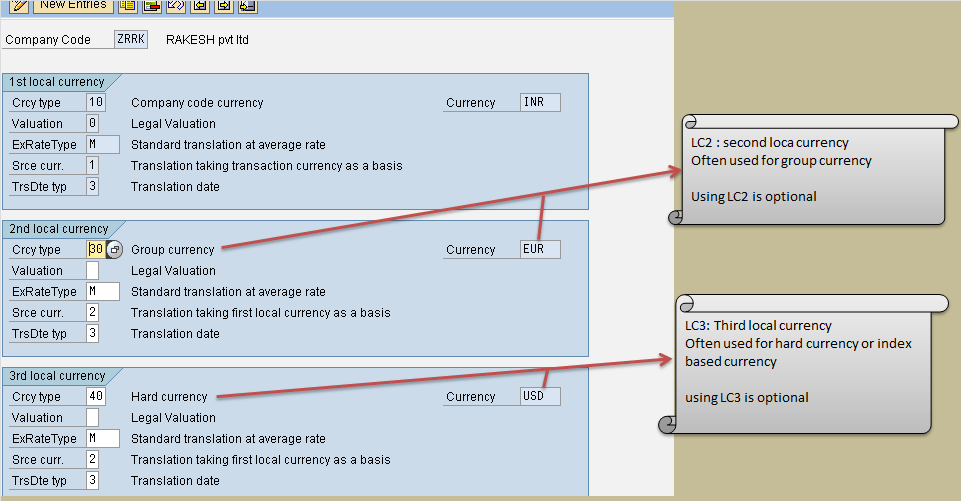

First local currency (LC1) is by default company code currency and cannot be changed.

Second local currency (LC2) is usually group currency (using LC2 is optional).

Third local currency (LC3) can be hard currency or index based currency (using LC3 is optional).

Non leading ledger:

First local currency (LC1) is by default first local currency of leading ledger or company code currency. (Cannot be changed)

Second local currency (LC2) is usually group currency. (Using LC2 is optional)

Third local currency (LC3) can be hard currency or index based currency. (Using LC3 is optional)

LC2 & LC3 currency of non-leading ledger must be one of the currencies which are used in leading ledger. Currencies other than which are used in leading ledger cannot be used in non-leading ledger.

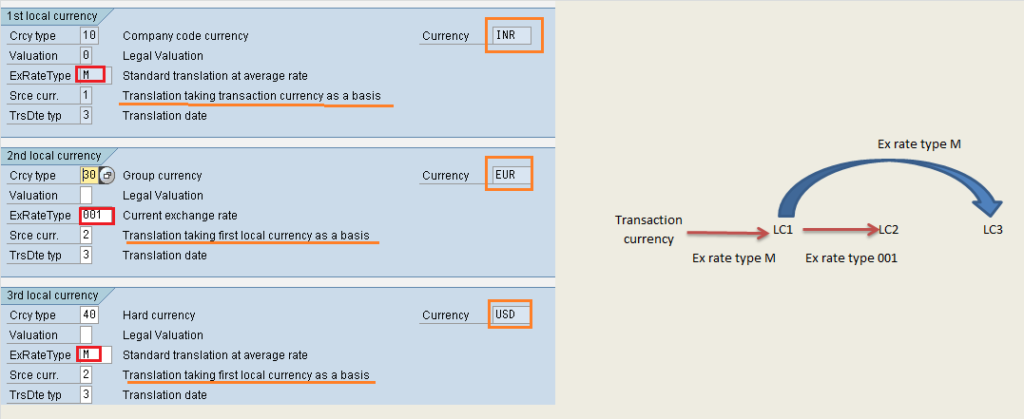

Below picture shows configuration of currency types in a ledger (T code: OB22)

Let's understand how currency conversions are handled in sap

To understand currency conversions in sap we need to understand below terminologies.

Exchange rate type:

When bank sells dollar, exchange rate might be $1= 65 INR

But when bank buys dollar, exchange rate might be $1= 70 INR

Hence different exchange rate is used for different purposes.

Above example can be represented as,

Transaction: Bank sells dollar Exchange rate type used: B

Transaction: Bank buys dollar Exchange rate type used: G

Exchange rate is maintained per exchange rate type as shown below

Exch rate type B, 1 $= 65 INR

Exch rate type G, 1$= 70 INR

Hence different exchange rate types can be used for different business transactions.

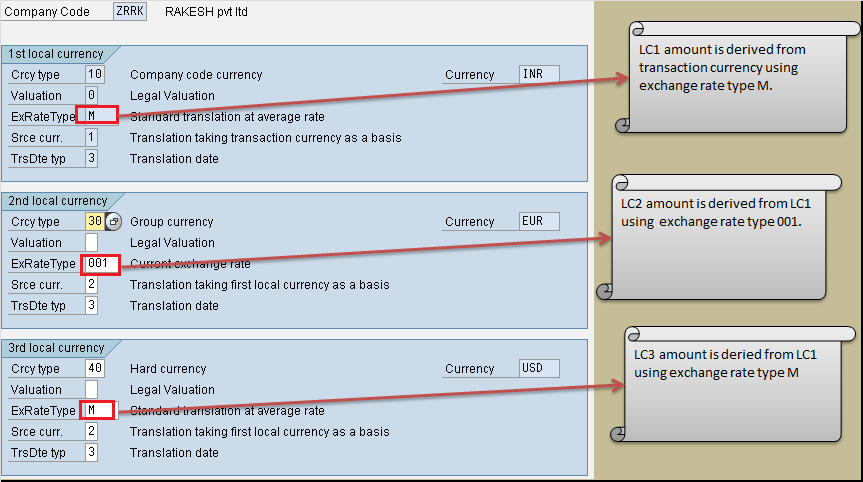

Whenever a currency conversion has to happen, first thing decided by system is what exchange-rate-type is going to be used. Exchange-rate-type to be used is maintained on the same screen where you are defining parallel currencies for ledger.

First local currency (LC1) is derived from transaction currency exchange using rate type M.

Second local currency (LC2) is derived from first local currency (LC1) using exchange rate type 001.

Third local currency (LC3) is derived from first local currency (LC1) using exchange rate type M.

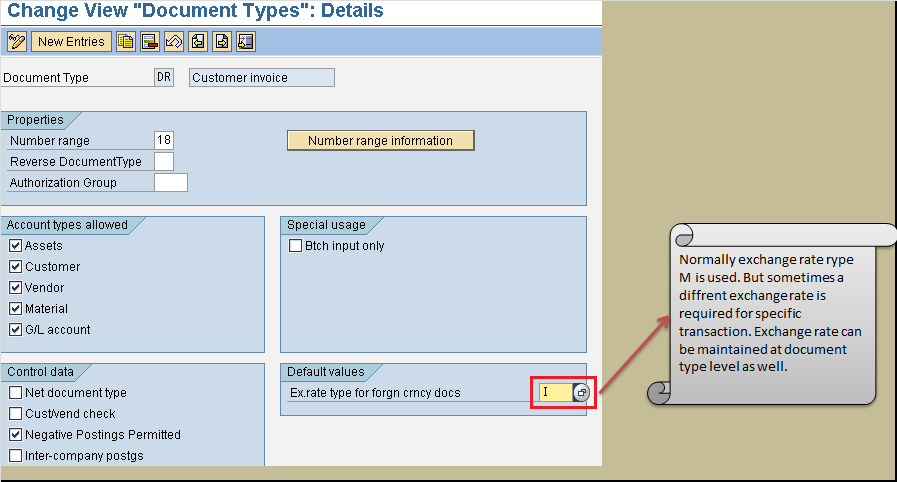

By default sap uses exchange rate type M for most of the currency conversions. But sometimes a different exchange rate type is required for specific business transaction. This is achieved by maintaining exchange rate type in document type definition itself. This particular document type will use exchange rate type assigned to it.

Currency translation ratio:

If I have to maintain exchange rate between VND (Vietnamese dong) and USD (US dollar)

1 VND = 0.0000446030 USD

Sap can handle at most 5 decimal places hence above will get treated as .00004

Same currency exchange rates can be maintained as

100,000 VND = 4.46030 USD (this is much better way to maintain VND vs USD)

Here currency translation ration between VND & USD is 100000: 1

Sap mandates that for every pair of currency, translation ratio has to be maintained.

Currency exchange rate:

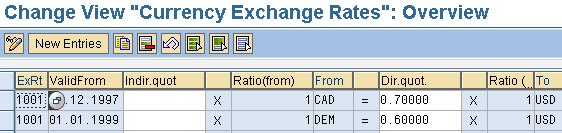

Currency exchange rate is maintained for below combination:

Exchange rate type + currency from + currency to + valid from

Exchange rate in sap is not maintained for each & every pair of currency; rather concept of reference currency is used.

Instead of maintaining

INR to GBP, INR to CHF, INR to CAD

GBP to CHF, GBP to CAD

CHF to CAD

I will maintain

INR to USD, GBP to USD, CHF to USD, CAD to USD

Here USD is made the reference currency. All currency rates are maintained against USD.

From currency—> USD —> To currency

This way exchange rate between any pair of currency can be derived using reference currency USD.

What the benefit of using reference currency?

Benefit is less number of exchange rate entries to be maintained.

Suppose there are 100 different currencies involved, hence exchange rate is to be maintained for 4950 pairs of currency.

But by using reference key, only 100 currency pair needs to be maintained. (each currency with reference currency).

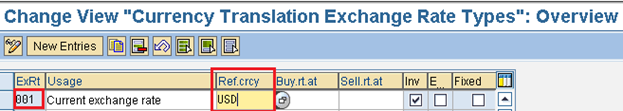

Reference currency is assigned to exchange rate type.

Now let’s put everything together and try to understand how currency conversions happen in sap:

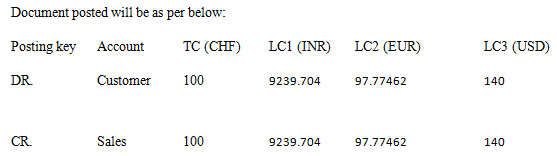

Assume main company is in Europe and Indian subsidiary company sold product to customer in Switzerland.

Transaction currency : CHF

Local currency: INR

Group currency: EURO

Hard currency: USD

Consider ledger has been set up as below

Consider below document is entered

Document is entered with 100 CHF.

While posting the document, system will derive LC1, LC2 & LC3 currency amounts.

Here you can see, exchange rate is maintained using translation ratio.

Exchange rates between currency pairs getting derived using reference currency USD.

Hope this example explains how currency calculation happens in sap.

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING