Before understanding asset class let’s understand how depreciation works and various other terminologies involved in asset accounting:

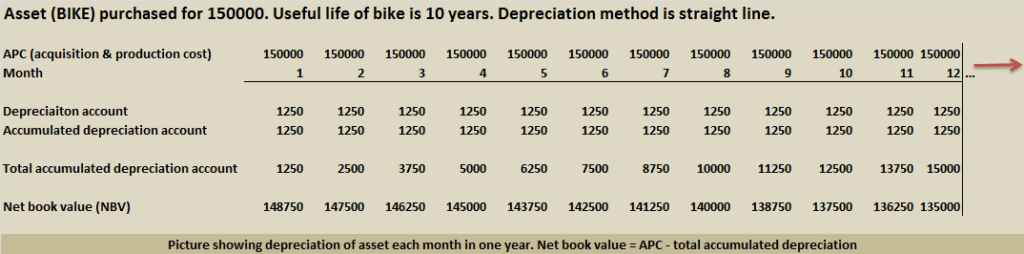

Consider an example, asset (BIKE) is purchased for 150000 with useful life 10 year. Asset is to be depreciated using straight line depreciation method.

Below accounting document for depreciation of asset will be posted every month in account books.

Depreciation account 1250

CR Accumulated depreciation account 1250

This accounting document gets posted automatically in sap once depreciation run is performed in sap. Depreciation run is performed every month end in sap using T code AFAB which we will cover in detail at later stage.

As of now, the question is how system calculates depreciation amount and from where system picks GL account for depreciation account and accumulated depreciation account.

Depreciation amount calculation

Total initial cost = 150000

Total life 10 year = 120 months

Depreciation method is straight line, hence depreciation per month= 150000/ 120 = 1250

There can be various other depreciation methods but in our example we have taken straight line depreciation or linear depreciation.

Hence depreciation amount calculation depends upon APC (acquisition and production cost), useful life and depreciation method.

Let’s understand below terminologies which are going to be used in asset accounting.

APC (Acquisition & Production cost):

Total cost which is paid to get the asset. Asset is either produced in-house or purchased externally or may include a mix of both. Whatever is the total cost incurred to get the asset is referred as APC, it may include vendor bill amount, freight cost, custom charges, installation cost etc.

Useful life:

Life over which asset is supposed to be used. At the end of useful life asset is supposed to be left with zero value or scrap value. Useful life of asset is decided by guidelines provided in respective country’s accounting principles. Hence different accounting principle may suggest different useful life for the same asset as per their respective accounting principles.

Depreciation key:

Depreciation key is basically method of depreciation. There can be various method of depreciation like linear depreciation, declining balance method, maximum amount method, multilevel method etc.

An asset is depreciated using suitable depreciation method or in other words an asset is assigned suitable depreciation key.

Account determination key:

There are many transactions done with asset. Depreciation is just one of the transactions.

Whenever any transaction is performed with asset, corresponding accounting document gets generated automatically. Sap picks GL account for posting accounting document by using account key. Account key holds the information about which GL account is to be picked for what transaction.

Account key is assigned to asset.

Understanding asset class

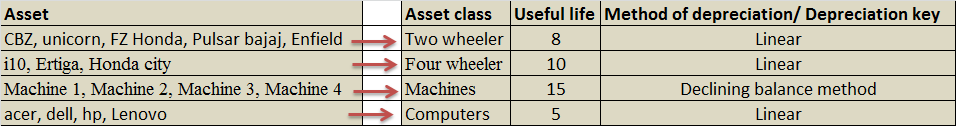

Assets which have common characteristics like same useful life, same method of depreciation and uses same GL account for posting accounting document are said to belong to same asset class. Hence asset class is grouping of assets which have same common characteristics.

Example :

You may have different bikes: CBZ, unicorn, FZ Honda, Pulsar bajaj, Enfield, etc

You may have different cars: i10, Ertiga, Honda city etc

You may have different machines: Machine 1, Machine 2, Machine 3, Machine 4 etc

You may have different laptops: acer, dell, hp, Lenovo etc.

You may have purchased each asset at different prices hence each asset may have different APC value.

Assets with common characteristics belong to same asset class.

What is the use of asset class in asset accounting?

Asset of similar nature are created under same class. Asset inherits below properties from asset class under which asset is created:

Useful life:

Useful life is maintained in asset class. When asset is created, useful life of asset is inherited from asset class. Inherited useful life can be changed manually in individual asset master.

Depreciation key:

Asset inherits depreciation key from asset class. Depreciation key can be changed in individual asset manually.

Screen layout:

When you try to create an asset, you will come across various fields in asset master which can be mandatory, optional or suppressed. This filed status setting is captured in screen layout. Screen layout is assigned to asset class. Hence when an asset is created, screen layout is picked from asset class under which the asset is being created.

Account determination key:

Account determination key is basically used for telling the software which GL account to use for posting accounting document for the asset transaction. Account key is assigned to asset class. Asset created under asset class inherit account key.

Number range:

Asset class is assigned a number range. When asset is created under the asset class, asset is created with a number belonging to asset class in sequential order.

Since asset inherits properties from asset class. Hence by maintaining properties for asset class we are saving our time & effort in maintaining for each & every asset individually.

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING