Whenever an organization purchases product or service from vendor, vendor sends bill to organization. The amount of money which is to be paid to vendor is called accounts payable.

Procurement department raises the purchase order, Goods/ services are received. Bills received from vendor are handed over to finance department. Finance department creates vendor invoice. It’s the responsibility of finance department to pay to vendor on time.

What are the challenges in accounts payable process?

- Making sure that vendor gets paid on time.

Organization have huge list of vendors. Organizations keep receiving goods/ services from vendor and vendor sends bills accordingly. Out of thousands of bills, keeping track of which bill is paid and which bill is due for payment becomes difficult. - Different payment method involved.

A vendor may need to be paid by ‘check’ but other vendor may need to be paid by online bank transfer. Hence different payment method for different vendors, hence bills need to be segregated depending upon payment method. This makes is difficult to track. - Sending payment information to banks.

Employee needs to prepare payment information to bank so that bank can process the payment to vendors. Manual intervention invites scope for error and hence lot of rework. - Bank reconciliation

When vendor payment is done, money is deducted from organization’s bank account and paid to vendor’s bank account. Hence employee working in accounts payable module needs to coordinate with bank to reconcile organization’s account books with balance in bank account. Employee also needs to communicate with vendor to keep the vendor informed that payment has been initiated for so and so bills.

With large number of vendors and huge list of bills, it becomes very difficult for employee working in account payable to keep track of all the things.

How sap helps to overcome these challenges?

- Sap makes tracking of vendor invoices very easy: open & cleared status of invoice

Whenever bill from vendor is received, vendor invoice is posted in sap. Vendor invoice by default is created in open status, open status means that payment is not yet done for the invoice. Once invoice is paid, status of the invoice changes from ‘open’ to ‘cleared’.

Vendor invoices can be segregated into open & cleared by simply executing report (T code: FBL1N). - Automation of payment process, reduced manual intervention

Sap helps in automation of below manual activities:

“Selecting invoices for payment and segregating them as per due date for payment, sending the information to bank for payment, providing information to vendor regarding payment of invoices.”

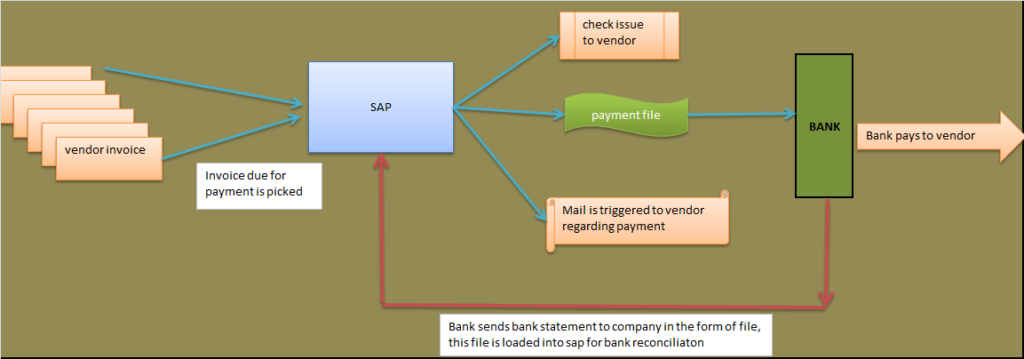

Using sap, invoices due for payment are automatically picked, payment file is auto generated which is sent to bank for payment, bank reconciliation process is automated, e mail with attached payment advice is sent to vendor automatically whenever payment of vendor invoices is initiated by organization. - Easy bank reconciliation

Employees don’t need to spend their entire time on coordinating with bank to reconcile organization’s account books with balance in bank account.

Sap automates the process of bank reconciliation which reduces time consuming manual activities.

Organization receives bank statement from bank (in the form of files over internet), these files are picked and processed by sap jobs. On successful processing of bank statement, document is posted which enables bank reconciliation.

Above picture summarizes the accounts payable process in sap.

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING