Before understanding depreciation key lets understand depreciation method and period control method.

When depreciation is run end of the month then below accounting document gets posted.

In order to be able to post above document, sap software needs to calculate depreciation amount.

For sap to be able to calculate depreciation amount, below inputs needs to be provided to sap:

1.Depreciation method:

Different depreciation calculation method will lead to different depreciation amount. Below some of the depreciation calculation methods are shown for understanding the concept:

Straight line depreciation

Declining balance method

Written down value method

Multi level method

Maximum value method

Appropriate method is used for calculation of depreciation of the asset.

2. Period control method

Consider an example: Company has fiscal year from January to December.

Asset acquisition

Asset is acquired on 7th July.

Now, when depreciation run is performed end of the month (July), what should be depreciation start date?

Should depreciation start date be 1st July and depreciation calculated for entire 1 month?

Should depreciation start date be 1st Jan of the same year and depreciation calculated for 7 month?

Addition of asset:

Asset is added on 10th August.

Should depreciation be charged starting from 1st August and depreciation calculated for entire 1 month?

Should depreciation be charged starting from 1st Jan of the same year and depreciation calculated for 7 month?

Asset retirement:

Asset is retired on 17th Sep.

Should effective date for depreciation calculation be taken 1st September?

Should effective date for depreciation calculation be taken 1st October?

Should effective date for depreciation calculation be taken 1st January?

Asset transfer:

Asset is transferred on 22nd Nov

Should effective date for depreciation calculation be taken as 1st November?

Should effective date for depreciation calculation be taken as 1st December?

Should effective date for depreciation calculation be taken as 1st January of the same year?

Effective date plays an important role in depreciation calculation. Different effective date will lead of different depreciation amount. Hence, input (instructions) needs to be given to sap on the basis of which sap can determine effective date for depreciation calculation.

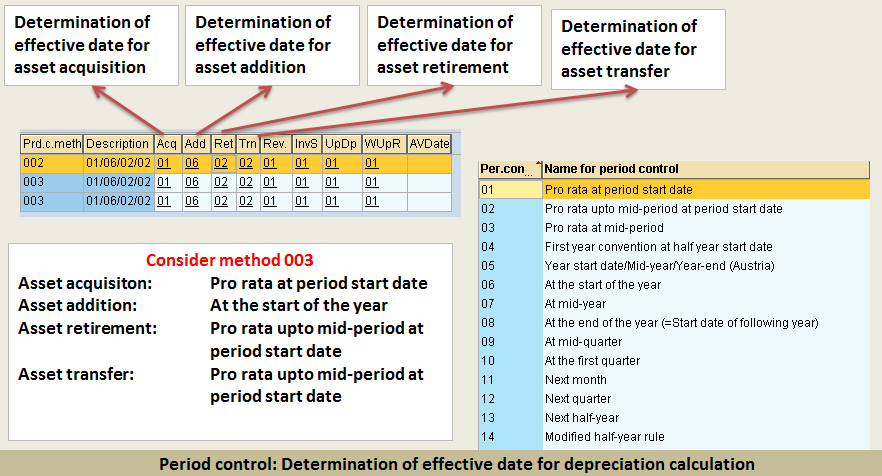

Instruction for determination of effective date for depreciation calculation is supplied to sap in the form of period control.

Now let us understand how instructions are captured in period control.

Period control is used for determination of effective date for depreciation calculation.

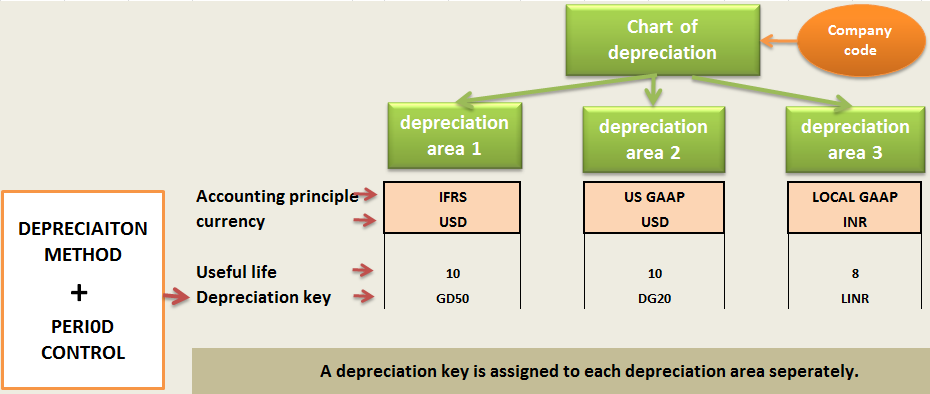

→ Depreciation calculation method and period control both are captured in depreciation key. Depreciation key is assigned to asset class.

→Depreciation key is assigned to each depreciation area separately.

→ When an asset is created, asset automatically gets the depreciation key which is assigned to the corresponding asset class..

Below link to help you understand depreciation key better

https://blogs.sap.com/2013/09/11/different-methods-of-depreciation-calculation/

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING