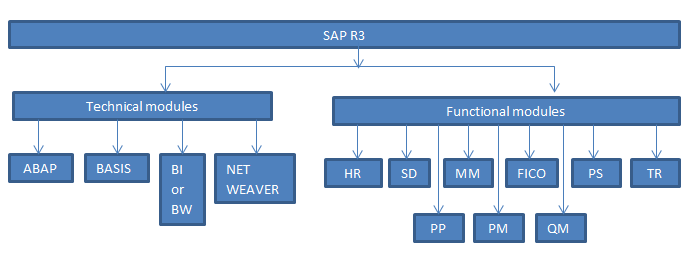

Modules in SAP can be classified into two categories: technical module & functional module.

It’s important to understand what is meant by functional module and technical module, how functional module is different from technical module.

SAP functional module: In order to replicate and enable business process, SAP offers various predefined or standard functionality to help departments in performing various business activities. The SAP modules which provide predefined standard functionality to replicate actual business activity are called functional module. A functional consultant has to understand the business requirement and use the standard functionality provided by SAP.

SAP technical module: These modules do not directly replicate actual business activity but provide needed support to functional modules.

Let’s understand functional modules in SAP.

In an enterprise, different activities are performed by various departments.

Production department:

Responsible for making sure that raw material is converted into finished goods in cost effective manner and adhering to production schedule. The production department uses material, labor, machinery and a variety of techniques to be able to produce finished goods. Production department relies on the purchasing department (material department) to get the materials and accessories that are necessary for the production of goods.

Plant maintenance department:

In a plant there are machines and equipment which are subject to wear & tear and might lead to production break down impacting productivity. Hence in order to keep the factory/ plant running efficiently regular check-ups, cleaning, repairing & maintenance activities are required. If production breakdown occurs, plant maintenance department is responsible to reduce the down time and hence improve productivity. For proper planning of maintenance activities maintenance department has to coordinate with material department and production department.

Materials department:

Responsible for ensuring adequate supply base to production department. It takes care of movement of materials including purchasing of material and services. Material department covers purchasing activities and hence responsible for maintaining relationship/ agreement with supplier to ensure continuous supply in cost effective manner.

Quality department:

The product/ services offered by company have to meet certain standards of quality. This department is concerned not just with quality of end deliverable but also with quality of input materials and quality of process. If quality of materials purchased from vendor/ subcontractor does not match quality standards then material is rejected. If finished goods produced do not match quality standards, goods are either issued for rework or scraped. Sold goods returned from customer are tested for quality and decision is taken either to scrap or rework.

Quality department works in coordination with material department and production department.

Human resource department:

Responsible for recruitment, training, manpower planning, Firing & layoff. This department closely interacts with finance department for payroll processing and manpower planning.

Sales & Distribution department:

Responsible for meeting sales target by bringing sales orders. Sales department is responsible for managing relationship with customers. Distribution department ensures that once sales order is received from customer then goods or services should be delivered to customer on schedule through proper channel and in cost effective manner.

Finance department:

Responsible for book keeping, recording all financial transactions done by company, generate financial reports for statutory/ legal purposes as well as providing reports to management for better decision making.

Project Planning:

When an organization takes up project like construction of building/ bridge, production, investment or any other complex project which runs for longer period of time and consumes huge amount of resources (men/ material/ machine/ money/ time). Such projects often run behind schedule and lead to big financial loss due to cost overrun.

So what needs to be done to complete such big projects successfully within schedule and within budget?

Big project is broken down into various activities (Work is broken down). These activities might be interdependent (start of one activity might depend upon completion of previous activity). Each activity is broken down into various well defined tasks. For each activity, date scheduling is done, resources are planned, budget is allocated and a designated person is responsible for successful completion of that activity.

Well defined milestones with proper deadline dates are set.

Each activity is monitored for cost and schedule so that project remains on track. If each activity is executed successfully then entire project get executed successfully.

Let’s take an example of Delhi Metro project understand the concept better:

Project would have been schedules for few years. Entire project might have been broken down into well-defined activities; activities might have been broken down into well-defined task. For each activity: date scheduling would have been done, resources would have been planned, money would have been budgeted and a person responsible would have been designated.

Actual cost incurred in each activity would have been recorded and compared with budgeted. Any variance would have been analysed for root cause and corrective action would have been taken.

Hence key to successful execution of a big complex project is to break down complex project into smaller well defined manageable activities and monitoring each activity closely.

This requires close coordination between planning department and other departments especially with finance department.

SAP PS module enables organization to list down entire project into broken down activities, date scheduling considering dependency between activities, planning of resources, budgeting of money and designated person responsible. Each and every cost incurred is recorded, any deviation from budget is analyzed and corrective action is taken hence enables proper cost monitoring. SAP PS module closely interacts with SAP FICO module.

Treasury department:

Treasury department is responsible managing liquidity of business which involves knowing exact cash position and forecasting future cash flows. It is also responsible for investing excess cash and hedging activities as per company investment policy.

Challenges faced by treasury department: number of subsidiaries which deals with various banks, large number of transactions with customer (account receivable) and vendor (account payable), investment into various securities like debt/ equity/ commodity/ derivatives which are subject to risk, weak IT system due to use of multiple software with weak interface between them. Hence knowing exact cash position and forecasting future cash flows becomes very difficult.

In order to perform duty treasury department has to work in close coordination with finance department. Treasury department has to enable and closely monitor accounts receivable and account payable.

Hence a system is required which can overcome above challenges (where all details can be put together for a comprehensive view and analyzed for better decision making).

SAP treasury module enables the organization to overcome the challenges faced by treasury department. Treasury department works in close coordination with finance. SAP treasury module also keeps the system audit-able hence legal/ regulator friendly.

To fulfill business activity, these departments interact with each other. SAP is software which is to replicate actual business structure. SAP modules are designed in such a way that each module can replicate the activities performed by respective department.

SAP PP- Production Planning

SAP PM- Plant Maintenance

SAP MM- Material Management

SAP QM- Quality Management

SAP HR- Human Resource

SAP SD – Sales & Distribution

SAP FICO – Finance & Controlling

SAP PS – Project system

SAP TR – Treasury

Let’s understand technical modules in SAP.

SAP BASIS:

This team is responsible to install, configure, update, patch, migrate, troubleshoot any technical problem on SAP system to ensure system runs smoothly.

BASIS is basically concerned with application layer of the three layers of R/3. (Presentation layer, Application layer and Server layer). Hence basis basically emphasizes the administration of RDBMS (Relational Database Management System – or simply the database sap system is using), client-server architecture and the SAP GUI.

Hence BASIS team is basically system administrator.

SAP ABAP:

SAP offers predefined functionality to meet business requirement. But predefined functionality may not suffice to fulfill business requirement hence customization is needed. Standard or predefined functionality is basically set of codes which are already developed by SAP hence when customization is required to meet requirement either new codes are developed or existing standard code is copied and edited.

ABAP stands for Advanced Business Application Programming. It’s a programming language in which codes are written. ABAP runs on the application layer of R/3 system.

E.g. Boss’s need various reports to make decision hence SAP offer a large number of predefined reports. But in case, exiting report is not able to fulfill requirement then new report is to be developed. Report can be developed either by copying existing code and editing or by developing entirely new codes.

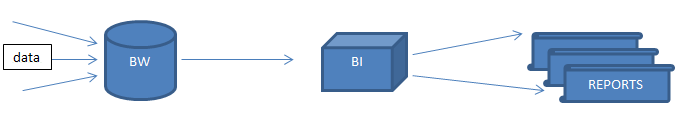

SAP BI & SAP BW:

In big organizations everyday huge amount of data is generated. In order to make strategic business decision, bosses need to analyze the performance/ position of business (backed by data). Data needs to be collected at one place and analyzed to derive meaning full information out of it.

But organizations face challenges like: data is generated globally, data is originated from various sources, data may not be uniform, data may be redundant/ duplicate as well.

SAP BW/ BI offer solution to above problems.

Data across geographies/ sources are collected at one place called data warehouse (BW). BW is basically home to all data and hence BW stands for business warehouse.

Data is then cleansed to remove redundancy/ duplicity and data is aggregated and made uniform which can be used for generating meaning full report out of it. These reports provide meaning full information or intelligence and hence BI stands for business intelligence.

SAP NET WEAVER:

Organizations have become big and robust. Organization might be using various SAP applications as well as non-SAP applications (other than SAP). In order to run business effectively various applications and servers need to interact with each other. SAP NET WEAVER provides a common platform where various applications/ servers can be integrated.

Example: consider an e-commerce company using SAP applications. Customer can order product online (website). Website might be based on JAVA application. Company is using SAP to streamline internal business process and JAVA is being used for website. Hence data needs to be exchanged between both java server and SAP server. Here the challenge is integration of various applications/ servers. This module overcomes the challenge by bringing all application/ servers on a common technology platform and hence called NET WEAVER.

Looking for training? Fill up the form for demo class.

Click on below link to read more on SAP FICO

BASIC CONCEPTS & GL ACCOUNTING

- What is SAP Finance ?What business requirement is fulfilled in this module?

- What is sap enterprise structure?

- What is difference between company and company code in sap?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- Non leading ledger helps in parallel accounting. Explain with example

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- How exchange rate is loaded in sap?

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- How sap overcomes challenges in accounts payable process?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price calculation in very simple terms.

- House bank, Bank key, Account ID

- What configuration (FBZP) needed for executing F110 in sap ?

- Understanding steps to execute F110 in sap

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

- How tax is calculated in purchase order and sales order?

WITHHOLDING TAX

- Withholding tax explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- What is APC (Acquisition & Production cost)?

- Depreciation area and Chart of depreciation

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

- What are different reports required by business